Trumponomics Paradox: 4.3% Growth, but “People Are Hurting”

Bessent predicts a “feast” in 2026

In today’s newsletter: A piece on economic growth and Treasury Secretary Bessent, a piece about Ben Sasse, a link to recent work, a billionaire’s exit from Britain, a correction.

Call it the juxtaposition of the day: the dueling Bloomberg headlines, one “U.S. Economy Grows at Fastest Pace in Years With 4.3% GDP Gain,” another, “US Consumer Confidence Drops for Fifth Straight Month.”

It nicely captures the paradox of hard economic data showing strong growth, and soft survey data showing weaker vibes. Some of this is partisan—Democrats in the surveys don’t like or trust Trump or congressional Republicans, and that colors what they tell pollsters about the economy.

Readers may recall our headline from November 19, 2025, “U.S. Economy Growing at 4.2 Percent, a Federal Reserve Estimate Says,” and the accompanying article noting “That’s a significantly higher reading than most forecasters expect,” and that it was useful for “illuminating negativity bias in the press.” (The press was largely ignoring it).

The remarkable thing, though, is that even President Trump himself and his top economic policy advisers, like Treasury Secretary Bessent, acknowledge that Main Street isn’t deluded when it feels strain or affordability concerns. “We understand that the American people are hurting,” Bessent said in an appearance on the December 22 “All In” video podcast. “People are seething over the high price level.”

Bessent made a lot of news in that appearance, which struck me overall as thoughtful and realistic. Some of the key points include:

2026 may be even better than 2025. “2025 was setting the table. And, especially on the economy, I think the the feast and the banquet’s going to be in 2026,” Bessent said. “I think 2026 is going to be a very good year for the American people, for Main Street…2025 was a capex [capital expenditure] boom.” He made the point that working Americans will get a bump in early 2026 in the form of tax refunds and lower withholding reflecting no tax on tips, no tax on overtime. “I also have the honor of being the IRS commissioner, and I can see that we’re going to have a gigantic refund year in the first quarter because no one changed their— working Americans did not change their—withholding. So I think households could see depending on the number of workers, $1,000, $2,000 refunds. They will change their withholding schedule at the beginning of the year and they will get an automatic increase in the real wages.”

On the tariff case at the Supreme Court: “I think the framing thus far has been very poor because it’s viewed as 0 - 1. It’s up - down. My guess is, it will be more nuanced.” He sort of dodged the question of why Trump did not go to Congress in the first place to ask for the tariffs. (At the recent After Neoliberalism conference at Harvard’s David Rubenstein Treehouse, Harvard’s Learned Hand professor of law, Jack Goldsmith, predicted the Supreme Court will rule against Trump in the tariff case).

On China: “We are in an economic war.”

On the Fed: Bessent talked about interviewing candidates for chairman of the Federal Reserve: “each one of them has talked about moving back toward the more traditional Fed role…just getting the Fed back into the background. You know, it wasn’t meant that the market and the economy and the American people were supposed to hinge on every word. It was supposed to be a predictable process…they’ve talked about what should we do with the regional banks. No one’s talking about getting rid of them or the regional bank presidents, but should each one of the regional banks have a specialty, go back to a center of excellence?”

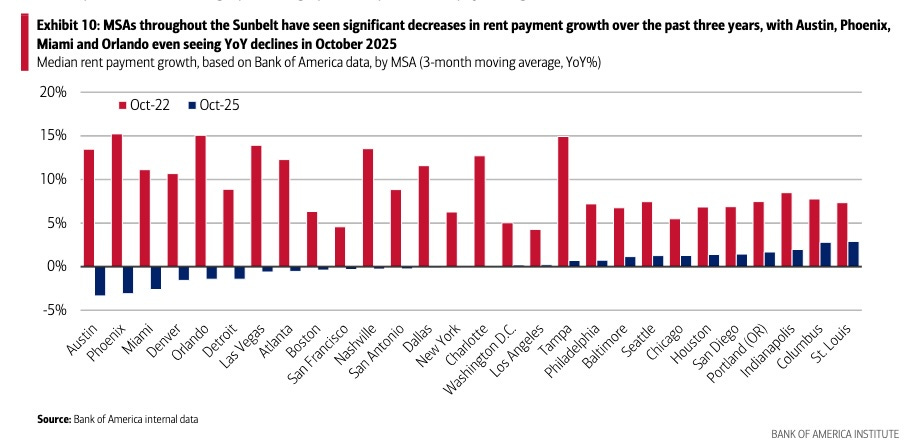

On rents: “rents are down and we are now seeing the effects of what 10 to 20 million undocumented people coming into the country did for rents.” Lower rents and lower gas prices mean that the inflation reality on the ground may be even better than the “surprise” consumer price index number.”with rent, with energy that those are very large components that have turned down substantially that actually recorded a gain for that measurement period” in the CPI report.

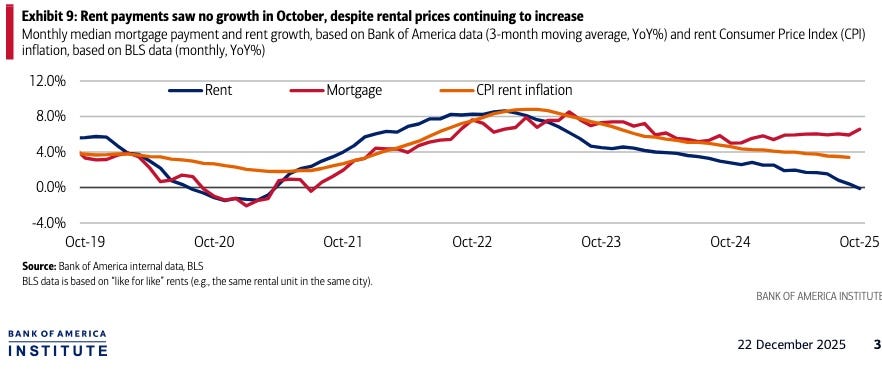

Bessent did not mention it, but I noticed recently that Bank of America has rent data based on people paying their rent using Bank of America accounts.

The Bank of America data show rent expenses going down more sharply than the CPI reports. I’ve been writing about rent so much here it sounds like a real estate trade publication, but between rent and owner-equivalent rent or “imputed” rent of owner-occupied housing, it’s a significant chunk—about a third—of the inflation data that helps to drive Federal Reserve interest rate decisionmaking.

On Trump accounts: “When we look back in 50 years, I think this administration will have saved or created the idea that everyone is an equity owner, that everyone has a stake in the market. Right now, about 38% of Americans do not own equities either directly or through some kind of a 401k or something. … we will close the gap over time. We’ll go from 38% not owning equities that if this continues hopefully that can be zero and everybody gets a stake in American prosperity, that American innovation .. Look at sort of the the polling for young people in terms of their view of socialism, their their view of capitalism…I think this is going to make the everyman and woman a market participant. And I think it’s fantastic.”

On markets in general: “The markets are biology. They’re not math. They’re not physics. They’re nonlinearities. They’re very complex systems.”

Complex systems are hard to predict, but if Bessent is correct and 2025 was setting the table and 2026 is the feast or the banquet, we would not be surprised here to see some quarterly or even annual growth numbers starting with 5 or 6, not 2, 3, or 4. People have forgotten what is possible on the upside. If the Supreme Court does strike down the tariffs and Trump wants them enacted by Congress, you could also see them paired with some sort of payroll tax cut so that the combined effect is neutral or a cut, not a tax increase. That could goose growth, and help on the “affordability” issue, even more.

Ben Sasse: The former president of the University of Florida and former U.S. senator from Nebraska, Ben Sasse, a member of the Harvard Class of 1994, announced today, “Last week I was diagnosed with metastasized, stage-four pancreatic cancer, and am gonna die.”

That is really terrible news, and I am praying for some sort of miracle cure. I am an admirer of Sasse and have written about his post-October 7, 2023 statement. In my Education Next article about college presidents, I wrote, “While serving in the Senate, Sasse wrote a whole book about the idea of ‘community, friendships, and relationships’ as the antidote to the crisis of loneliness and deaths of despair.” (The book was “Them: Why We Hate Each Other--and How to Heal.”)

Here was Senator Sasse in March 2018 about Trump’s tariffs: “Let’s be clear: The president is proposing a massive tax increase on American families…You’d expect a policy this bad from a leftist administration, not a supposedly Republican one.”

In a December 2023 New York Sun column, I mentioned Sasse on a list of those who could help fix Harvard: “He got the response to October 7 right in a way that won national attention and that contrasted with how Harvard bungled it. As an undergraduate at Harvard, he was on the wrestling team. He’s written for the Atlantic about higher education.”

In a November 12, 2025 post at The Editors, “What Zohran Mamdani’s Strategist Gets Wrong About the ‘Working Class,’” I mentioned that Sasse had worked a summer job detasseling corn, a reminder that class divisions and occupations are more fluid and less permanent than some analysts claim.

He had just been announced as a regular contributor to the Wall Street Journal’s “Free Expression” opinion project and I was looking forward to reading his work there.

One of my former New York Sun colleagues, Mike Saucier, died in 2017 at age 46 of pancreatic cancer, 30 days after being diagnosed. It’s a terrible disease.

Perhaps among Sasse’s many substantial contributions to America and higher education will be adding some additional urgency to the effort to cure pancreatic cancer through some combination of profit motives of pharmaceutical companies, government funding of science and health research, and philanthropic support.

Recent work: “1619 Project’s Nikole Hannah-Jones Mourns Cop-Killer Who Escaped to Cuba” is the headline over a story I wrote for the Washington Free Beacon. You can check it out there if you wish by clicking the headline.

Billionaire exit: Alan Howard, cofounder of Brevan Howard Asset Management, has left the UK for Switzerland, according to Bloomberg, which estimates Howard’s fortune at $4.3 billion. “Howard’s departure signals growing unease among Britain’s home-grown talent as they grapple with higher taxes on everything from private equity investments to inheritances to capital gains under Keir Starmer’s Labour government,” Bloomberg says, noting that other wealthy Brits who have left recently include Ian and Richard Livingstone, who went to Monaco, and Jeremy Coller, who went to Switzerland.

It reminds me of that New York Times news article, “Some studies dispute the claim that wealthy individuals flee high-tax states.” Or the classic New York Times headline from 2013 (with a “common sense” column label, no less) “The Myth of the Rich Who Flee From Taxes.” Some myth. The only thing more mythical is credibility of the New York Times on the topic of taxes and mobility.

Correction: I-278 is the designation of the interstate highway that runs beneath the Brooklyn Heights Promenade. The Cuomo Bridge carries I-87 and I-287. The numbers were inaccurate and conflated in the initial version of a December 16 post here. The post has since been updated and now also includes a statement from a New York Times spokesman defending the Times article about the stretch of highway.

Thank you: The Editors is a reader-supported publication that relies on paying customers to sustain its editorial independence. If you know someone who would enjoy or benefit from reading The Editors, please help us grow, and help your friends, family members, and associates understand the world around them, by forwarding this email along with a suggestion that they subscribe today. Or send a gift subscription. If it doesn’t work on mobile, try desktop. Or vice versa. Or ask a tech-savvy youngster to help. Thank you to those of who who have done this recently and thanks in advance to the rest of you.

The news about Ben Sasse is very sad. I had the occasion to talk with Sasse after Harvard ROTC Commissioning in May, and he came across as very smart and likable.

In releasing the bad news about his cancer, Sasse "recounted recent milestones from his children’s lives, including [his daughter] Corrie’s commissioning into the Air Force". I had the privilege of describing in the WSJ what happened during her commissioning: https://www.wsj.com/opinion/not-everything-at-harvard-needs-improvement-rotc-trump-adinistration-9b144fd7?st=qmDKJr&reflink=desktopwebshare_permalink

Give 'em 6-7 months more of the "economy-goosing" they're doing and still plan to do, and people – for the most part – are going to feel pretty darn good.

Recall they got a lot out of the Congress and they're using the executive lever like no peacetime President ever did. It's one helluva lot of federal power. The Supreme Court could throw a monkey wrench in the tariff portion; so, we'll see about that. And how many more Fed rate lowerings? 'don't know.

But it's still quite an extraordinary fiscal/government push. I wouldn't bet against the impact it'll have.