Even Another Month With No Inflation May Not Move Powell

Plus, majority of New York voters oppose the Israel-hating socialist, new poll shows

In today’s newsletter: Previewing tomorrow’s inflation numbers; where the New York mayoral race stands; and writer Gary Shteyngart’s taxes.

The Bureau of Labor Statistics is scheduled to release tomorrow the June Consumer Price Index numbers. For the purpose of measuring inflation in setting interest rates, the Federal Reserve pays closer attention to the Personal Consumption Expenditures index, which comes out with a longer delay. But the CPI, which measures prices, is a factor in calculating the PCE, which measures spending, so it’s significant. Or it would be significant, if there were a Federal Reserve that were operating empirically based on data rather than prospectively based on expectations.

The New York Times wrote about this the other day in a news article. “Part of Mr. Trump’s rationale for reduced interest rates is that there is ‘no inflation.’ It’s a point that economists and policymakers broadly refute despite a recent string of milder data because of widely held forecasts that the president’s tariffs will lift consumer prices at least temporarily this year,” the article said.

Trump was elected in November 2024 after campaigning on a promise of tariffs. He was inaugurated in January 2025. He announced a lot of tariffs on April 2, 2025, “liberation day.” Some tariffs have been delayed until August 1, 2025. Does the Fed really want Americans to pay higher mortgage rates and auto loan rates, want businesses to pay more to borrow money, until Trump’s tariff policies are entirely digested? There are a lot of factors influencing the economy and prices other than tariffs, and, with the June numbers, the Fed will have three months—April, May, and June—of post-Liberation-Day price data.

Senator Rick Scott, Republican of Florida, posted to social media today, “Jay Powell aided and abetted Joe Biden’s inflation nightmare every step of the way, and now he’s doing everything he can to undermine President Trump’s America-first economic agenda. The Federal Reserve is failing American families. Powell MUST go!”

There’s a military adage about always fighting the last war. Powell and the Fed seem to think the lesson of the last war is that they were too loose against inflation. A different lesson is that they were too slow to react to data. We’re in a real-time world in which retailers like Amazon and even hotel and transportation companies—airlines, Uber, have algorithms that constantly monitor prices and adjust them dynamically instantaneously. Yet the Fed is waiting 15 days past the end of the month for federal data that it will then consider at a previously scheduled meeting July 29-30. Trump’s tweets are being interpreted as attacks on Fed “independence.” They may be that, but Trump may also be correct with his assessment of Powell and the Fed bureaucracy as “too slow.”

Bloomberg’s Jonathan Levin bends over backward to try to rebut the point I made back in April in “Groupthink Sets in at Powell’s Federal Reserve”:

Since the mid-1990s or so, dissents against policy decisions have become much less common, particularly among governors. That the public has the impression that dissent is dying is unfortunate, and I blame poor Fed communication and internal customs for allowing the idea to fester. It is, nevertheless, wrong.

There is still plenty of lively debate on the FOMC. Nowadays, a lot of that discussion happens before policymakers gather for their rate decisions. Unlike earlier eras, governors and Reserve Bank presidents spend many hours during the inter-meeting periods making their case to the public in speeches and interviews. In effect, the policy decision is litigated on CNBC and Bloomberg, and then everyone comes together and tries to project unanimity.

That may be good for CNBC and Bloomberg, but it’s a strange way to run policy or to set the U.S. government’s borrowing costs. “Litigation” involves two parties and a judge and a jury, not a Fed official handpicked by the chairman speaking before a friendly audience or a captive press corps. Where’s the constitutional accountability?

Senator Scott, at least, is living up to his responsibilities in Article I, which gives Congress the power to coin money and regulate its value. So is Rep. Ritchie Torres. The more of their colleagues weigh in, the greater the likelihood that the inflation data won’t be seen as the latest episode in a Trump-Powell psychodrama but rather a step toward Congress reasserting its constitutional role in monetary policy.

New York mayoral race: Right up there with Trump-Powell in terms of newsworthiness is the New York mayoral race.

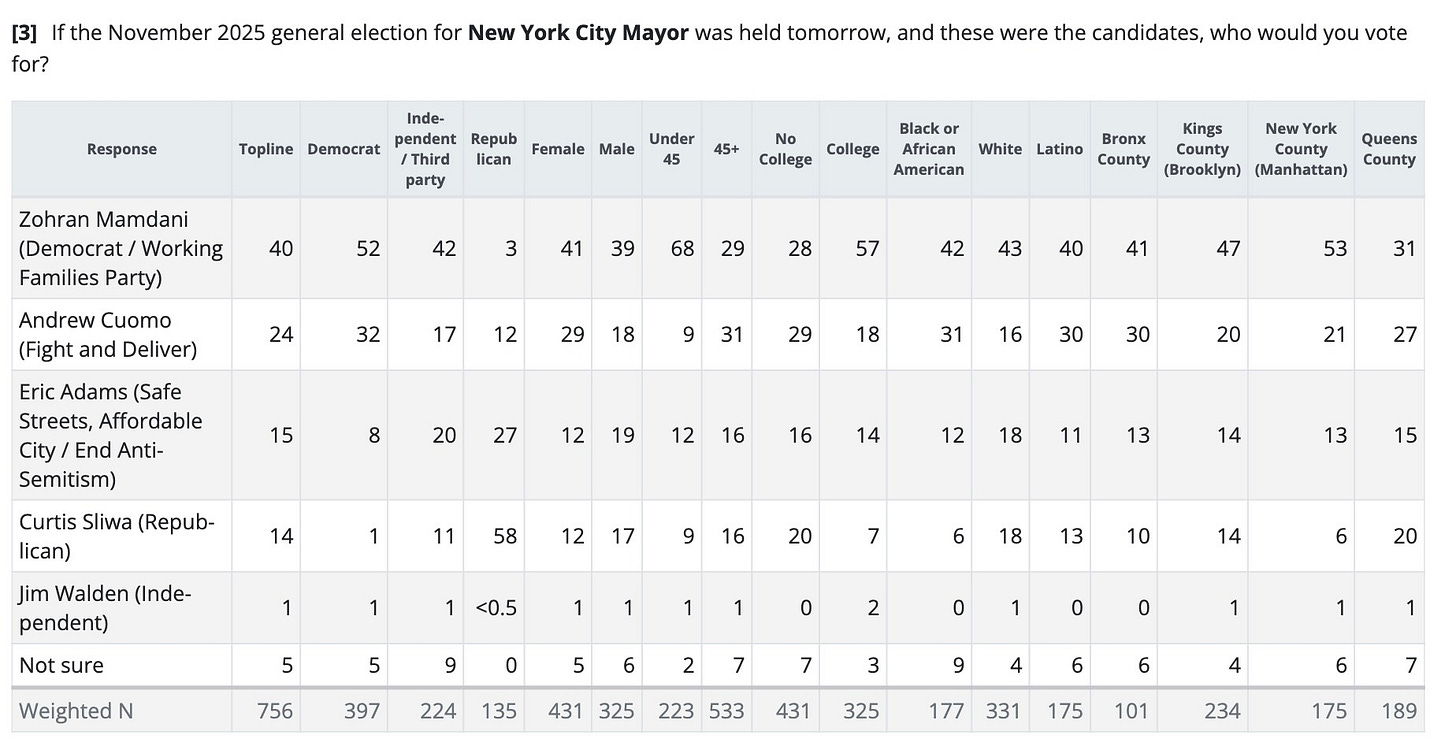

In a Data for Progress survey of 756 likely voters fielded July 1 to 6, 40 percent said they would vote for Mamdani, while the combination of Sliwa, Adams, and Cuomo attract 53 percent. If the anti-Mamdani coalition unites around one candidate, it could win. The other standout items from the crosstabs are the differences in Mamdani support about voters who went to college and those who did not, and those who are younger than 45 and those who are older. The Mamdani voters are younger and college-educated.

Mamdani’s most recent social media policy-oriented video was emphasizing what he called a Bloomberg idea about dedicated fast bus lanes. He seems to be running the the center for the general election in an effort to reassure voters who are skeptical about installing an Israel-hating socialist.

At a recent cabinet meeting, President Trump raised hopes that if Mamdani takes over and tries to ruin New York, Trump would step in somehow to stop him. He spoke about taking over New York City the way he is offering (or threatening, depending on how you see it) to do in the District of Columbia.

Shteyngart’s taxes: The New York Times has a profile of writer Gary Shteyngart that mentions his $10,000 suit and a watch collection of 30 timepieces, kept in a safe in his Manhattan apartment, including a “Patek Philippe Aquanaut, which can sell for more than $100,000.” It mentions “Mr. Shteyngart spends about half the year in his house upstate.”

Why “about half”? The Times doesn’t get into it, but people who live more than half of the year in New York City are on the hook for New York City income tax at a marginal rate of 3.876%. Maybe Shtenyngart’s decision isn’t entirely tax-driven, but maybe if New York City eliminated its income tax more of the apartments that now sit empty much of the year would be filled with people enriching the economy and intellectual life of the city rather than counting days in the Hudson Valley.

Know someone who would enjoy or benefit from reading The Editors? Please help us grow by forwarding this email along with a suggestion that they subscribe. Or send a gift subscription:

This line from that Bloomberg columnist is unadulterated baloney: “Unlike earlier eras, governors and Reserve Bank presidents spend many hours during the inter-meeting periods making their case to the public in speeches and interviews”

If Jonathan Levin cares to look it up on the Bloomberg terminal that sits, presumably on his desk, he could well find hundreds of news articles written by Bloomberg News reporters going back decades prior to Powell’s term in which members of the FOMC and other Fed officials regularly made public remarks and gave interviews about their views on the economy and the likely direction of interest rates. There’s no more of that activity these days, there may be less for all I know – but the assertion that such speeches and interviews didn’t happen is utter garbage.

There is huge uncertainty over tariffs. Until that is resolved, expect huge uncertainty over inflation and interest rates. A drop in energy costs, however, can counteract some of the inflationary effect of tariffs.