Fed Chair Powell Claims “Healthy Diversity of Views” After Second Straight Unanimous Rate Decision

Plus: who threw the “free Palestine” brick through the window of a Boston kosher market?

Mark your calendar: coming this Thursday, June 19, at 10:30 am eastern time, we are planning a live video session with a New York City mayoral candidate, Whitney Tilson, who has been leading the fight against socialist boycott-Israel advocate Zohran Mamdani.

In today’s newsletter: the chairman of the Federal Reserve, Jerome Powell, speaks at a press conference following the Fed Open Market Committee’s decision to hold interest rates steady.

Also, Pepperdine and the Washington Institute for Near East Policy launch a new “Master of Middle East Policy Studies” degree program.

And, some clues to help the Brookline, Mass., police in their investigation of what they call “a disturbing act of hate and antisemitic vandalism.”

The “groupthink” at the Federal Reserve has become a theme around here (see the April 22, 2025 article, “Groupthink Sets in at Powell’s Federal Reserve”). In a press conference this afternoon, the chairman of the Federal Reserve, Jerome Powell, addressed the issue.

“We have a pretty healthy diversity of views on the committee,” he said.

Powell’s answer came in response to a question by Nick Timiraos of the Wall Street Journal about dispersion in the “dot plots” of the various Fed Open Market Committee members, with some expecting no cuts later this year, and others expecting more than one cut this year.

Powell went on to say that Fed Open Market Committee members may have different forecasts and different reaction functions, or assessments of the risks of inflation or unemployment based on a given forecast.

Terrific. But when it comes to what actually matters—the rate decision to keep the 4.25 percent to 4.5 percent target for the federal funds rate—here is how the Fed’s press release from 2 p.m today put it: “Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N. Jefferson; Adriana D. Kugler; Alberto G. Musalem; Jeffrey R. Schmid; and Christopher J. Waller.” It was a 12 to 0 vote.

The vote at the May 7 Fed meeting was also a 12 to 0 vote.

For contrast, check out another, healthier institution in Washington that also issued a decision today.

That is the Supreme Court. Its ruling in United States v. Skrmetti was summarized in the syllabus as follows: “ROBERTS , C. J., delivered the opinion of the Court, in which THOMAS, GORSUCH, KAVANAUGH, and BARRETT, JJ., joined, and in which ALITO, J., joined as to Parts I and II–B. THOMAS , J., filed a concurring opinion. BARRETT , J., filed a concurring opinion, in which THOMAS , J., joined. ALITO , J., filed an opinion concurring in part and concurring in the judgment. SOTOMAYOR, J., filed a dissenting opinion, in which JACKSON, J., joined in full, and in which KAGAN, J., joined as to Parts I–IV. KAGAN, J., filed a dissenting opinion.”

Powell, Chief Justice Roberts, and Justice Kavanaugh are all reportedly members of the Chevy Chase Club. Maybe the justices can teach Powell something over a round of golf.

No one wants the Fed press releases to read like 118-page Supreme Court opinions, and there is something to be said for a per curiam or unanimous Supreme Court decision as well, especially in a high-profile case.

But it doesn’t speak well of the Fed when even the Washington press corps—not an institution known for robust ideological diversity or independent thinkers—has more outside-the-box thinkers than the Fed Open Market Committee. At the press conference, at least three reporters pressed Powell on why he wasn’t cutting rates, and another reporter asked why no one was forecasting rate increases. That’s more heterodoxy than was shown in the Fed Open Market Committee, which could benefit from the addition of a voice like Scott “lower interest rates are overdue” Grannis.

Dissents in the pre-Powell era used to be much more frequent. Those dissents were a sign of the substantive intellectual diversity at the regional banks, which also was on display in their research agendas. That diversity, which enriched the Fed and contributed to good decisionmaking, has receded sharply, increasing the risk of big monetary policy mistakes such as moving too slowly to head off inflation, the mistake Powell and his handpicked crew made the last time around.

Anyway, Powell can talk all he wants about what he thinks is the “healthy diversity of views on the committee.” Maybe his definition of “healthy diversity” is a committee where no one publicly disagrees with him on rate decisions. It wasn’t so healthy when Powell kept the fed funds rate at zero all the way into March 2022 when Consumer Price Index Inflation was at 8.5 percent. Trump says he doesn’t plan to reappoint Powell as chair, but, as we’ve been saying here (see “The Fed Beyond Bessent,” June 11, 2025) getting the Fed functioning better is more than just a one-person job.

Clues in Brookline Butcherie brick attack: Here in the Boston area, in the Jewish community and beyond, this past weekend’s attack on a beloved kosher supermarket was a big deal.

Governor Healey spoke out about it, saying, “This is deeply concerning and totally unacceptable. Acts of violence and intimidation have no place in our communities. We stand with our Jewish neighbors against antisemitism. Everyone deserves to live, pray and do business without fear in Massachusetts.”

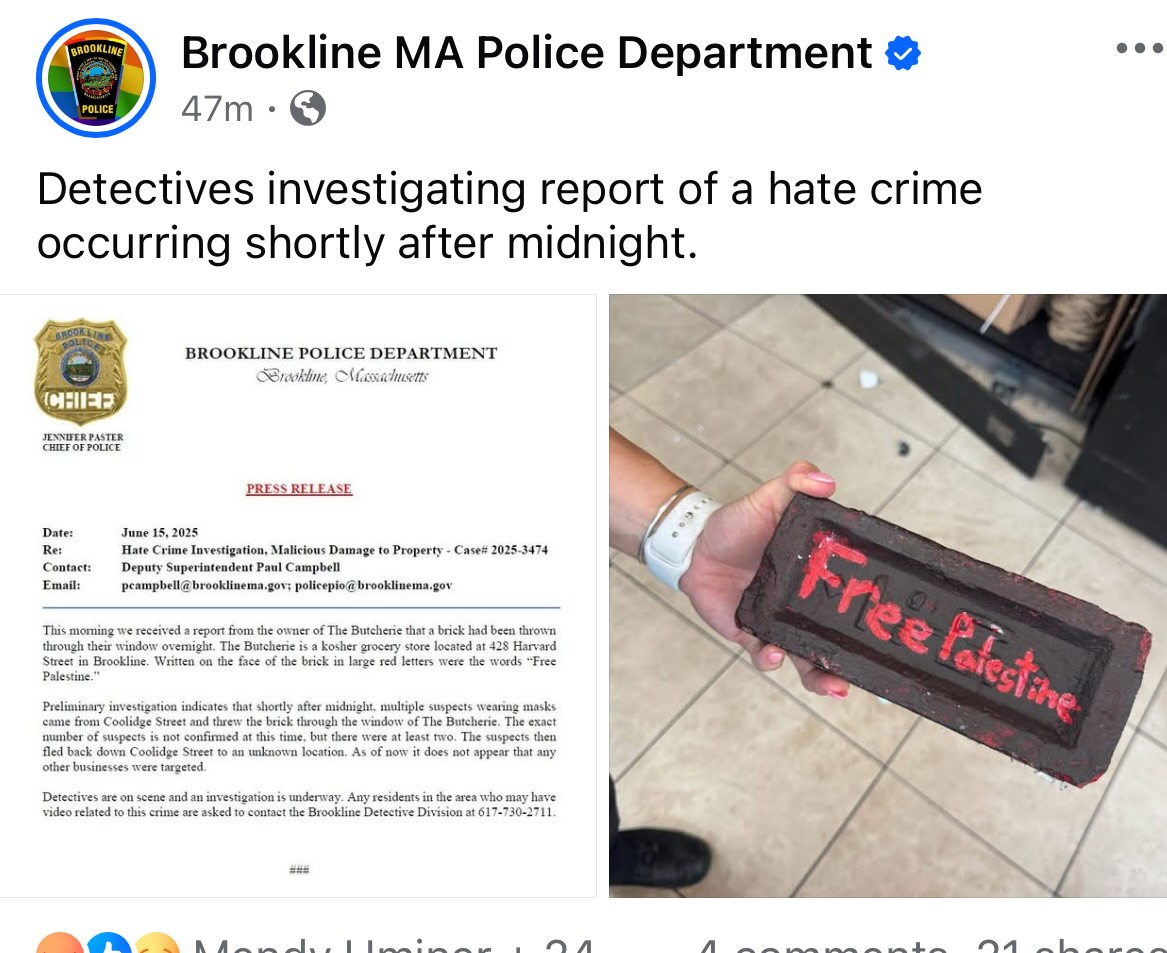

The chief of police in Brookline, Mass., the Boston suburb where the crime happened, put out a statement: “I am deeply saddened and outraged to report a disturbing act of hate and antisemitic vandalism that occurred overnight here in Brookline. A brick was thrown through the window of The Butcherie, a beloved kosher grocery store located on Harvard Street in Coolidge Corner. Written in large red letters across the face of the brick were the words ‘Free Palestine.’”

“This was not simply an act of property damage, and it is not plainly vandalism. This was a targeted, hateful message meant to intimidate a Jewish-owned business and our broader Jewish community,” she said. “The Brookline Police Department is investigating this incident as a hate crime, and we are fully committed to holding those responsible accountable.

Preliminary investigation indicates that shortly after midnight, at least two masked individuals walked from Coolidge Street, threw a brick through the storefront window, and then fled in the same direction.”

I have some ideas that could perhaps help find the perpetrator.

The red paint used to write “free palestine” on the brick reminded me of two other Boston property crimes that involved red paint: An October 8, 2024 early-morning window-smashing vandalism of University Hall at Harvard together with splashing red paint on the John Harvard statue in Harvard Yard in what was described as an “act of solidarity with the Palestinian resistance.” With a window smashing, red paint, and a Palestine angle, it sure looks like the Harvard Yard crime—which was never prosecuted or solved—has a similar profile to the Butcherie attack. Red paint was also used in a June 2025 vandalism of a George Washington statue in Boston’s public garden.

I’m no handwriting expert, but the handwritten “free palestine” letters on the Butcherie brick also reminded me of vandalism that I encountered, and took pictures of, in Boston’s Emerald Necklace parks on the morning of May 12.

I wrote about another, similar Emerald Necklace vandalism attack here back in September 2024 (“Anti-Israel Vandals Hit Boston’s Emerald Necklace”).

Finally, an X account called “Unity of Fields” reposted a supportive comment about the attack saying, “My guess? It has nothing to do with them being kosher and everything to do with their support for the genocide of Palestinians and the ongoing theft of land from both Palestine and Syria.”

The Anti-Defamation League has a recently updated and thorough backgrounder on Unity of Fields that says “Unity of Fields (UoF), formerly Palestine Action U.S., is a radical far-left, anti-Zionist ‘direct action network’ that engages in calls for violence against those it considers supportive of Israel or Zionism, or ‘complicit’ in Israel’s alleged actions, and promotes aggressive, targeted protests and the defacement of property belonging to Jewish and non-Jewish organizations and individuals.”

The Brookline detectives have been impressively capable and enterprising recently in a complex investigation that identified suspected burglars from Chile and Argentina who dragged a 400-pound safe out of a Chestnut Hill property. With luck the police will crack this case, too—and perhaps others along with it.

I hope the perpetrators are prosecuted to the fullest extent of the law. When criminals find that their actions are not punished with certainty or swiftness, they commit more crimes, is something that seems like common sense but that I think I also remember learning from James Q. Wilson.

I’m a happy, regular customer of the Butcherie so it’s even more troubling to see it violently attacked.

Pepperdine Middle East masters: The Pepperdine School of Public Policy just announced a new Master of Middle East Policy Studies degree in partnership with the Washington Institute for Near East Policy, including two-year full tuition scholarships, “irrespective of need,” for the Fall 2025 cohort.

Faculty will include Robert Satloff, Martin Kramer, Dennis Ross, and others. Pepperdine describes itself as “a learning environment where academic excellence is rooted in Christian faith and values” and says “The importance of faith in preparing ethical leaders and the foundational significance of religious liberty are integral to the program's teachings.”

Public policy schools and Middle East studies have both been highly problematic, as Kramer documented in his book “Ivory Towers on Sand: The Failure of Middle Eastern Studies in America.”

It’ll be interesting to watch this program—to be based in Washington, not Malibu—and to see if it can help improve the field by providing some competition and choice to the incumbents. I’ve been generally supportive of the Trump administration’s efforts to press the universities to improve, but as someone who believes that market-based solutions generally beat government regulation, it’s encouraging to see a new entrant to this field.