The Thune-Johnson Stock Market Selloff

A continuing resolution is no substitute for tax and spending cuts

Conventional wisdom about the cause of the recent stock market selloff has to do with President Trump’s increased tariffs and tariff-related threats against Canada, Mexico, and China. That and a radically revised downward view of the market value of Tesla, related to Elon Musk’s involvement in the Trump administration. It sent us back to reread our July 18, 2024, column, “Trump and Vance Could Crash the Stock Market.”

Okay, but the smart money view has been also—as Citadel Founder and CEO Ken Griffin put it, “for the United States, you know, all these issues around tariffs…It’s all second order. First order: we’re back to business.”

So what’s new? Speaker Johnson on Saturday March 8 rolled out a continuing resolution that would fund the government through September 30 and, as a CNN account put it, “buy time for Donald Trump and GOP leaders to steer key pieces of the president’s agenda through Congress this summer.” This summer? Why wait that long?

Trump and the Republican members of Congress were elected in November. Trump has managed to implement the tariffs—which are tax increases—already, without a six- or nine- or ten-month delay. The Senate was pliable enough to confirm, swiftly, nominees like Robert F. Kennedy Jr and Tulsi Gabbard. Why should non-tariff tax and budget policy proceed on Biden-style autopilot for another six months?

Trump had executive orders ready to go on day one. Why didn’t Johnson and Thune have a tax and spending bill ready? Not just a skeletal budget framework, but actual legislation implementing the key provisions?

Steve Forbes warned them. He wrote on December 17, 2024, “We Need a Big, Fat, Tax Cut Fast,” “Donald Trump’s second-term success depends on his getting a substantive tax cut bill passed—and quickly….The Trump team should start putting together a tax cut proposal ASAP. A running start come January could create critical momentum in getting a package fast-tracked through both congressional chambers through the reconciliation process….The big tax rate reductions of Ronald Reagan’s first term were fatally phased in, which meant that the real punch didn’t come until 1983, two years after the Gipper took office. The economy suffered from the delay, and the Democrats made sizable gains in the House in the midterm elections…A similar mistake was made in Donald Trump’s first term. The tax bill was delayed, not passing until December 2017. A year of extra growth was lost, and Republicans were decisively defeated for control of the House, with Nancy Pelosi becoming Speaker. Republicans shouldn’t again fall into the trap of delay.”

Forbes warned in December, “Another factor the GOP must keep in mind: tariffs. Depending on circumstances, President Trump will likely impose some. We’ll need big tax cuts to help offset them.” Thune and Johnson should have listened to Steve Forbes.

It’s usually a stretch to attribute any short-term market gyration to a particular cause, but one factor may be that Trump was starting to look less like a wrecking ball and more like a wiffle ball. When Trump told the Department of Government Efficiency to use a “scalpel” rather than a “hatchet,” it was another signal of business-as-usual rather than a path to a balanced budget.

Speaking at a Business Roundtable meeting on Tuesday evening, Trump said “the tariffs are having a tremendously positive impact.”

“It may go up higher,” Trump said, speaking of the tariff rates.

Part of the problem may be that the White House staff is confused about whether tariffs are tax increases or tax cuts. “Tariffs are a tax hike on foreign countries that again have been ripping us off. Tariffs are a tax cut for the American people,” the White House Press secretary, Karoline Leavitt, said in a clash with the Associated Press’s Josh Boak, who insisted that tariffs were “tax hikes.”

Senior White House Counselor Peter Navarro was on CNBC yesterday: "Let's remember here that tariffs equal tax cuts.” Huh? I guess one could say somehow that the tariff revenue will create budget space to extend corporate tax cuts and add cuts to income taxes on overtime and tips and social security benefits, or that the tariffs on imports will force activity eventually to move into America where it will be tax free, but in the meantime, the definition of “equals” is being stretched.

As we wrote here Thursday March 6, “the sooner Congress acts and provides some clarity and certainty on some of these tax and spending issues, the better. No one wants to rush anything through half-baked or attempt to do that only to discover belatedly that the votes are not there. But if the only tax action for the market and the media to fixate on is tariffs, the results will be what we are currently seeing, which is rocky.” That was before the announcement of Johnson’s proposed six-month extension of the Biden administration fiscal policy.

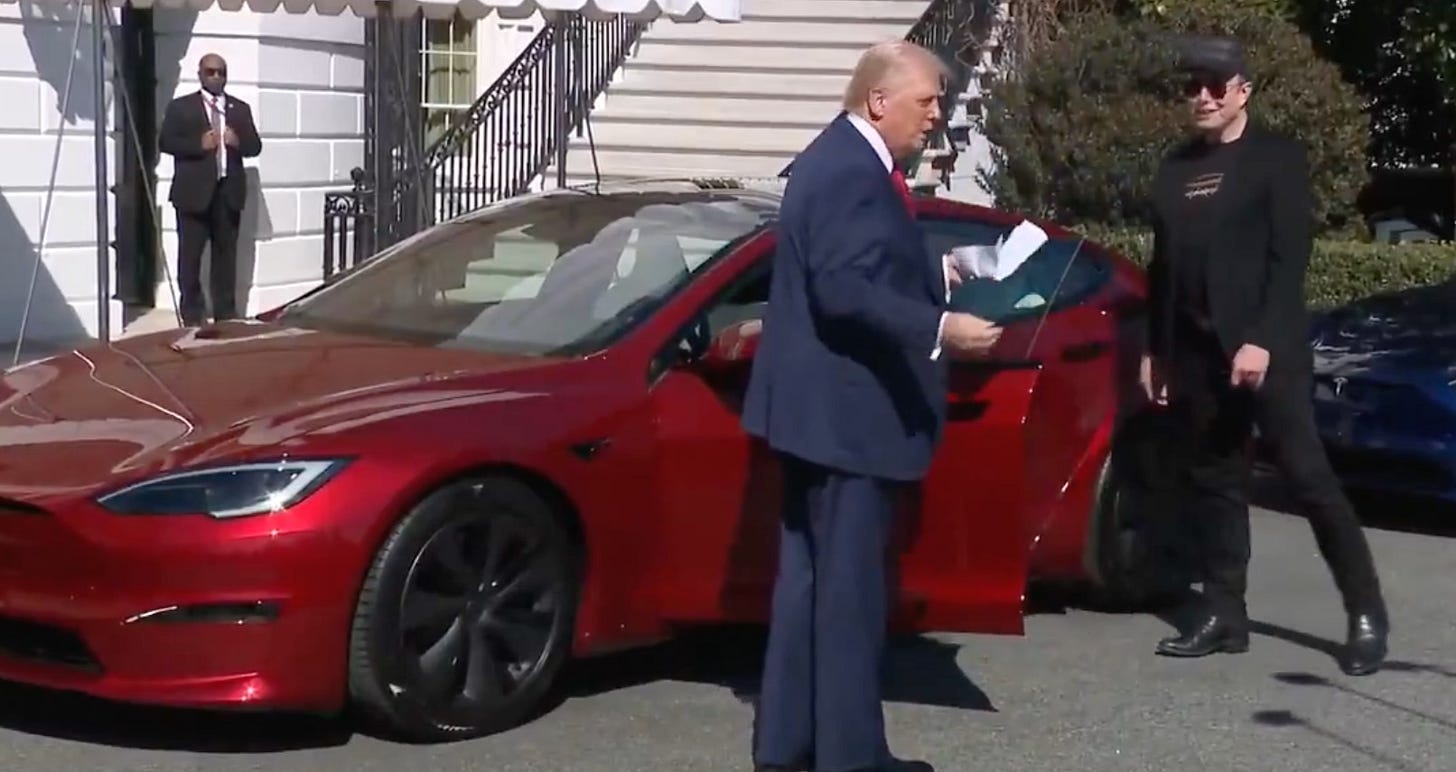

Trump spent part of this afternoon buying a Tesla. That car’s signature feature is its rapid acceleration. If Congress ever designed a car it would take six months to change gears. The sluggish vehicle could be marketed under the name the Thune-Johnson.

Cotton endowment tax: Senator Cotton is reintroducing legislation he calls the “Woke Endowment Security Tax,” or WEST Act. It would impose a one-time, 6 percent excise tax on the endowments of Harvard, Yale, Stanford, Princeton, Massachusetts Institute of Technology, University of Pennsylvania, Northwestern, Columbia, Washington University, Johns Hopkins, and Cornell. Unlike some other measures that target endowment income, this would be, according to the text of the legislation introduced by Cotton in the previous Congress, “a tax equal to 6 percent of the aggregate fair market value of the assets of the institution at the end of the preceding taxable year.”

Note that Donald Trump Jr. and Omeed Malik’s 1789 Fund is aiming to raise its $4 billion to $6 billion not only from “public pensions in Republican-controlled states” but also from “endowments.” If an investment in Trump Jr.’s 1789 Fund, which aims to invest in the so-called MAGA economy, which could be ammunition or Tucker Carlson’s network—can help avert a university endowment qualifying for the “woke” label, and the excise tax, it might make economic sense for the university, but it also might further illuminate the aspect of the whole thing that makes it seem like a shakedown.

While praising tax cuts for the rich, tell us why the carried-interest loophole is good for America.

Tariffs will create a renaissance in American manufacturing which will revitalize our hollowed out cities and create jobs for the despondent people living in those cities.

Additionally, and maybe more importantly, America's boom in manufacturing will give jobs to all those government employees who are about to be let go.

It take time to build a factory to replace a product that China was flooding our country with. A modicum of patience for this to play out is a sign of business acumen. Pressing the panic button is a sign of (fill in the blank).