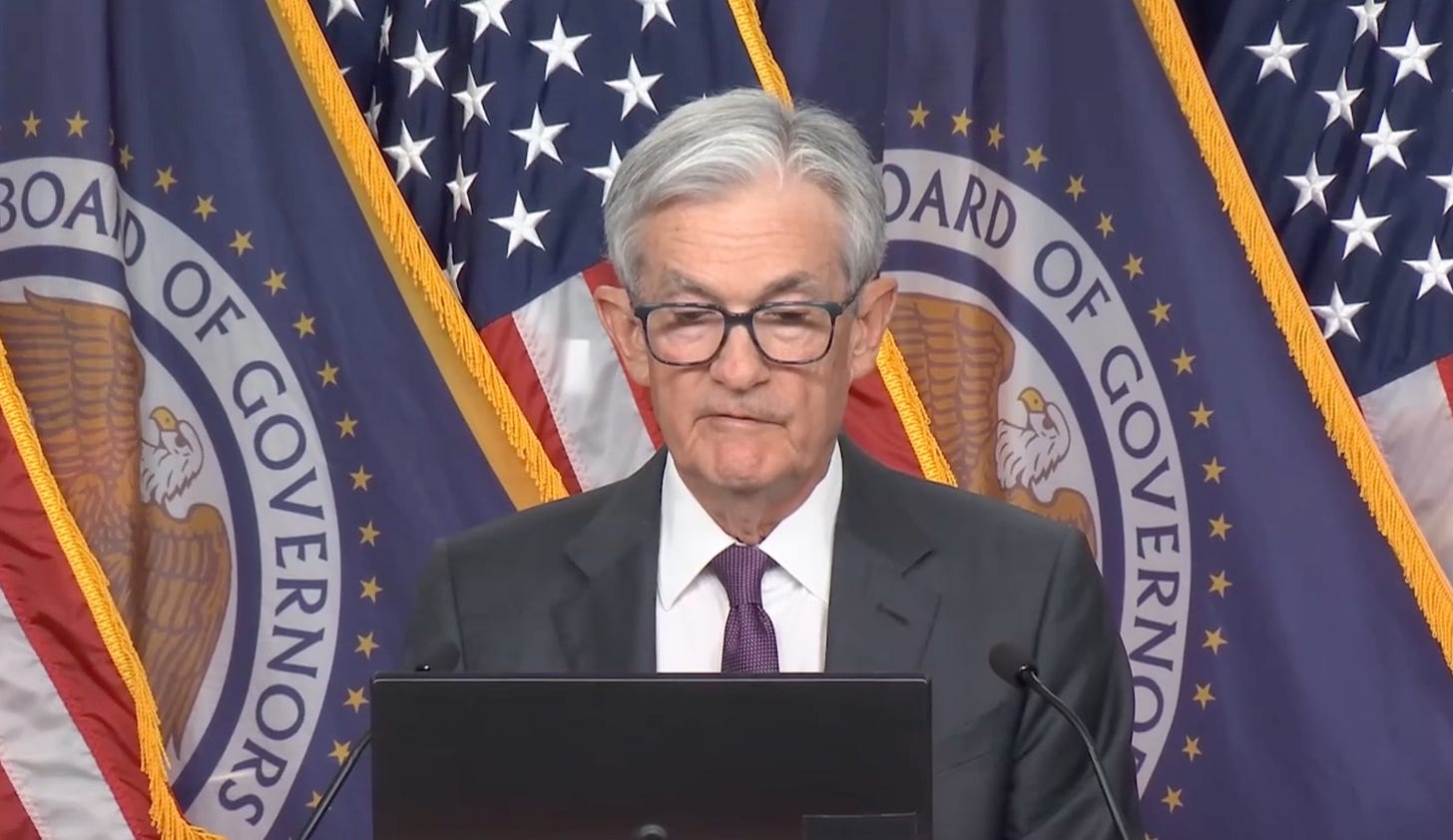

The Fed Joins the “Resistance”

Powell, Goolsbee, and Logan fight Trump

It’s understandable that the Federal Reserve should want to maintain its independence rather than appear to be directed by President Trump’s Tweets. Yet recent events are making it look like, rather than being nonpartisan, the central bank is actively trying to make Trump fail.

Yesterday saw a strong stock-market rally on the news that President Trump had put a 90-day pause on many of his tariffs. This morning brought a report on the Consumer Price Index that showed prices actually dropped in March, supporting the view that, as we quoted Scott Grannis earlier this week, “I detect no reason to worry about inflation.” You’d think that would help open the door to further rate cuts by the Fed.

Instead of being quiet or touting the welcome progress against inflation, Fed officials appeared in public, as if on cue, to douse hopes of a rate cut. The president of the Federal Reserve Bank of Chicago, Austan Goolsbee, spoke at the Economic Club of New York. “Goolsbee reiterated he still believes interest rates will be lower 12-18 months from now, but indicated the Fed is in a wait-and-see mode at present,” Bloomberg reported. Forbes quoted him as saying, “The Fed’s timetable is not the market, stock market’s timetable.”

Goolsbee was chairman of the Council of Economic Advisers under President Obama. He’s mentioned in that highly illuminating podcast by the former president of the Richmond Fed, Jeffrey Lacker, that we also flagged earlier this week. “I think that the Chicago appointment was striking, because it was Austan Goolsbee, with a partisan policymaking background. And the Fed has a history of trying to remain as non-partisan as possible.”

The president of the Dallas Fed, Lorie Logan, also gave public remarks today. “History teaches that when higher inflation expectations become entrenched, the road back to price stability is longer,” she said.

“A sustained burst of inflation could lead households and businesses to expect further price increases, especially following the persistently elevated inflation in recent years,” she said. “It will be important to keep any tariff-related price increases from fostering more persistent inflation. For now, I believe the stance of monetary policy is well positioned.”

You can interpret Goolsbee and Logan as independent actors, but the reality is that Powell is the calliope-master. As Lacker notes in the podcast, Powell and his board of governors have played an increasingly prominent role in picking the regional Fed presidents, in a way that has translated into “less of a propensity to express dissenting views.” Everyone’s on high alert about the stifling ideological conformity and absence of viewpoint diversity in elite higher education, but the Federal Reserve is giving the Ivy League a run for its money when it comes to homogeneity and obedience. Lacker notes this is true not only on monetary policy but even in the economic research published by the Fed, “an increasing share of the research is on progressive topics, so climate change, inequality, things that are important, but better addressed by Congress, in my view.”

What’s next, lawn signs outside the Marriner Eccles Fed headquarters building in Washington that say “not my president” or “In This House, We Believe…”?

It’s a shame, because the intellectual independence and diversity of the regional Fed banks used to be a real strength of the Fed structure. If the Fed misplays it and contributes to a recession by keeping rates too high for too long, the press and the Fed will blame Trump, not their own decisionmaking. Likewise, if things work out well in the end, Trump will take credit himself. One reason the Fed has survived as long as it has is that it is convenient for politicians to have someone other than themselves to blame. But Powell and his regional bank chairs are playing a risky game. No one elected them. In fact, in Goolsbee’s case, if you think of Goolsbee as Obama’s guy, the voters rejected Obama’s instructions to vote for Kamala Harris and instead chose Trump, a candidate that Obama portrayed as a threat to democracy.

If Powell’s goal is Fed independence, this sort of thing is counterproductive, because the more Trump and Congressional Republicans see the Fed as part of the resistance, the more likely it is that they move to restructure it in a way that diminishes the central bank’s autonomy.

Remember, before the presidential election, the Fed cut rates by half a percentage point in September 2024. After Trump won, there was another quarter-point cut in November 2024 and another quarter-point cut in December 2024, but since Trump has been inaugurated there have been two Fed Open Market Committee meetings with not a single rate cut at either one. Is the economic environment after Trump’s inauguration really so dramatically different than it was before the inauguration?

Everyone still remembers when, in 2019, the former Vice Chair of the Fed, William Dudley, wrote that the Fed should consider acting to oppose Trump on the grounds that “Trump’s reelection arguably presents a threat to the U.S. and global economy.” Dudley said then, “Officials could state explicitly that the central bank won’t bail out an administration that keeps making bad choices on trade policy, making it abundantly clear that Trump will own the consequences of his actions.” It sure looks like today’s Fed is following Bill Dudley’s advice.

People will say the stock market moves are really about Trump’s tariffs, not the Fed’s interest rates. They’ll say it’s not Powell’s job to bail the White House out of self-destructive trade policy. Like inflation expectations themselves these days, everything gets filtered through a tribal, partisan lens. When inflation was soaring because of spending by Biden and the Democratic Congress, Powell was slow to raise rates. That was also an error. The takeaway here is not about one day’s stock market moves. Nor is it to say that the Central Bank should always act—”yes sir! how high, sir?”—in the political interest of the party that controls the White House. Groupthink, though, is a risk, whether it is in the press corps or at the Federal Reserve. You’ll know Powell hasn’t signed up with the resistance if and when you hear any senior Fed official speculating publicly that maybe Trump is right when he says it’s time to cut rates. It’s not just what action the central bankers take at the Open Market Committee meeting. It’s the public communication strategy, and the narrowly constricted scope of the messaging. It doesn’t support good decisionmaking or inspire confidence.

Your recent critiques of the Fed suggest a rather narrow perspective on how worldwide capital markets operate which is not likely their perspective.

Even if the main tariff change is on imports from China, that will have an inflationary effect. It sounds like the fed is concerned about that scenario.