Kashkari, Collins, Williams Join the Fed Calliope

Chairman Powell’s resistance mounts

Financial markets are getting to a point where to interpret them, you almost need a degree in political science, not economics.

Here’s an April 3, 2025, Gallup Poll showing an eight percentage point gap between Republicans and Democrats when it comes to worry over inflation, with Democrats 23 points more worried than they were last year, and Republicans 18 points less worried than they were last year. The 2025 part is based on phone interviews conducted March 3-16, 2025.

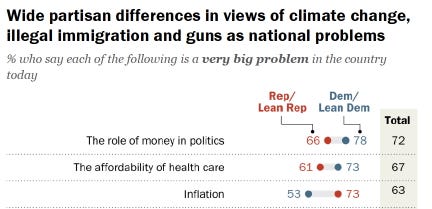

Pew polling conducted January 27 to February 2, 2025 found 73 percent of Republicans and only 53 percent of Democrats listed inflation as “a very big problem in the country today.”

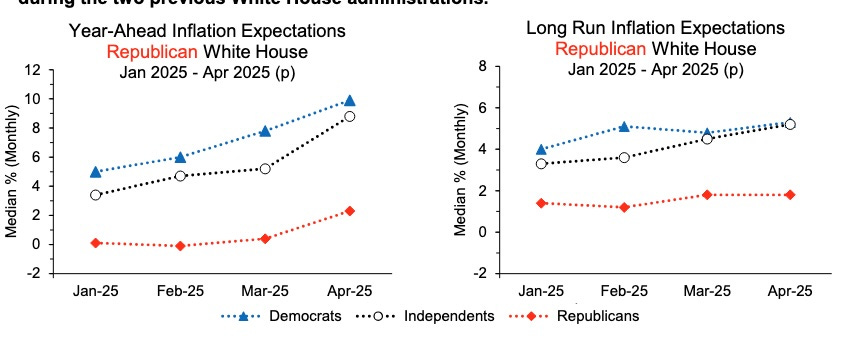

The University of Michigan has its own survey data—Joanne Hsu put out an April 11, 2025 report headlined “Partisan Perceptions and Sentiment Measurement,” that tracks the differences in short-term and long-term inflation expectations among Republicans, Democrats, and Independents.

And then there’s the now-famous Apollo rendering of the Michigan Survey’s “everyone switch sides” finding, which we ran here back on April 8.

We didn’t intend The Editors to be a daily Federal Reserve newsletter, and we don’t intend it to be. But one of the key aspects of “trustworthy information” is trying to pierce through the partisan bias. At the moment the biggest story is the calliope that Federal Reserve Chairman Jerome Powell is playing of Fed officials with a public relations campaign that expresses Democratic anxiety rather than empirical analysis.

Yesterday it was the president of the Federal Reserve Bank of Chicago, Austan Goolsbee, and the president of the Dallas Fed, Lorie Logan. Today it was the president of the Boston Fed, Susan Collins, who said rate cuts may be delayed: “my expectation is that we are likely to have to hold for longer than I had before.” The president of the Minneapolis Fed, Neel Kashkari, went on CNBC to announce that “it could be that investors are saying, OK, America no longer is the most attractive place in the world to invest.” He also echoed what CNBC called “other policymakers’ statements that rates are unlikely to move until there is clearer visibility on fiscal and trade policy.” And the president of the New York Fed, John Williams, according to Reuters, “said he expects the tariffs to push inflation up to between 3.5% and 4% this year,” though Williams did helpfully clarify, “this is not stagflation.”

Thanks for the reassurance.

The talkative Fed bankers may ask themselves whether their comments are helping the economy or hurting it. And if they care about a credible, independent Fed as an institution, they might consider the risk that Republicans are going to start viewing them as part of the anti-Trump resistance rather than as a data-driven, technocratic stabilizing force. Imagine if you had the Supreme Court justices all over MSNBC every day talking about how unconstitutional Trump’s executive orders are, or on Fox News talking about how outrageous Biden and Obama’s actions were. And imagine rather than a 6-3 or 6-4 or 3-3-3 court you had all nine arrayed unanimously against the executive branch. That is the tune being played at the moment on Jay Powell’s calliope.

The Anti-Pessimism Movement Grows: The “celebrate America” part of Jamie Dimon’s annual letter really resonated with me. Relatedly comes this new article in Persuasion by Nils Gilman, chief operating officer and executive vice president at the Berggruen Institute and a former Associate Chancellor of UC Berkeley, headlined, “How Universities Can Save Themselves.” He argues that the Humanities need “to reconceive themselves not as a site for remediating bad things about the past but rather as a site for preserving and transmitting what is worthy about the past.”

Gilman writes, “what must end is the view that the entirety of the present is best or even adequately represented as the fruit of the poisonous trees of past iniquities. Such cultural pessimism, which in some variations can verge on nihilism, is at odds with the research mission of the humanities, whose primary pedagogic focus must be providing students with knowledge and models from the past that can help them understand the present in more complete and nuanced ways. A due attention to the highest achievements of the past—I use the hierarchical metaphor deliberately— is the right and proper focus for a renewed humanities.”

Dimon was focused on America and Gilman is writing with a more global perspective. Smart people in academia understand this. It reminded me of Harvard professor Danielle Allen’s comment from back in 2021 on the Biden administration’s proposed history and civics education priorities: “We can deliver full and accurate histories that can empower all learners as civic agents standing on an equal footing with one another. This requires, however, not only bringing the wrongs to the surface but also bringing forward the positive visions of democratic possibility and constitutional self-government that all the peoples of this country have developed over time. The story of the innovations to overcome problems of racial injustice and other forms of domination…should be as central to this priority as the excavation of the failings of our constitutional democracy.”

You don’t have to be a right-winger to believe this. The Berggruen Institute isn’t right wing. Danielle Allen ran for governor of Massachusetts as a Democrat and left the Washington Post for the Atlantic amid the kerfuffle over the paper’s not endorsing Kamala Harris for president.

News from Harvard: “There is a long history of people in elite communities looking down on rural people,” says the top story in the university-published Harvard Gazette, quoting “A PhD graduate of Harvard's Kenneth C. Griffin Graduate School of Arts and Sciences,” Travis Donahoe, who grew up in Wayne County, West Virginia. The article seems microtargeted at getting Vice President Vance to back Harvard’s National Institutes of Health funding.

Recent work: “New York Times Takes Iran’s Side in US-Iran Talks” is the headline of my latest piece for the Algemeiner. Please check the piece out there (no paywall) if you are interested in that sort of thing.

Program notes: The Jewish holiday of Passover ends for me in the evening of April 20. The Editors will be back full force on Monday, April 21. Until then, we’ll be publishing less frequently than usual. Happy Passover and Happy Easter to our readers.