Donald Trump Jr. Joins the State-Pension-Fund Industrial Complex

Plus, new Syria regime is “ISIS on steroids,” an Israeli general says

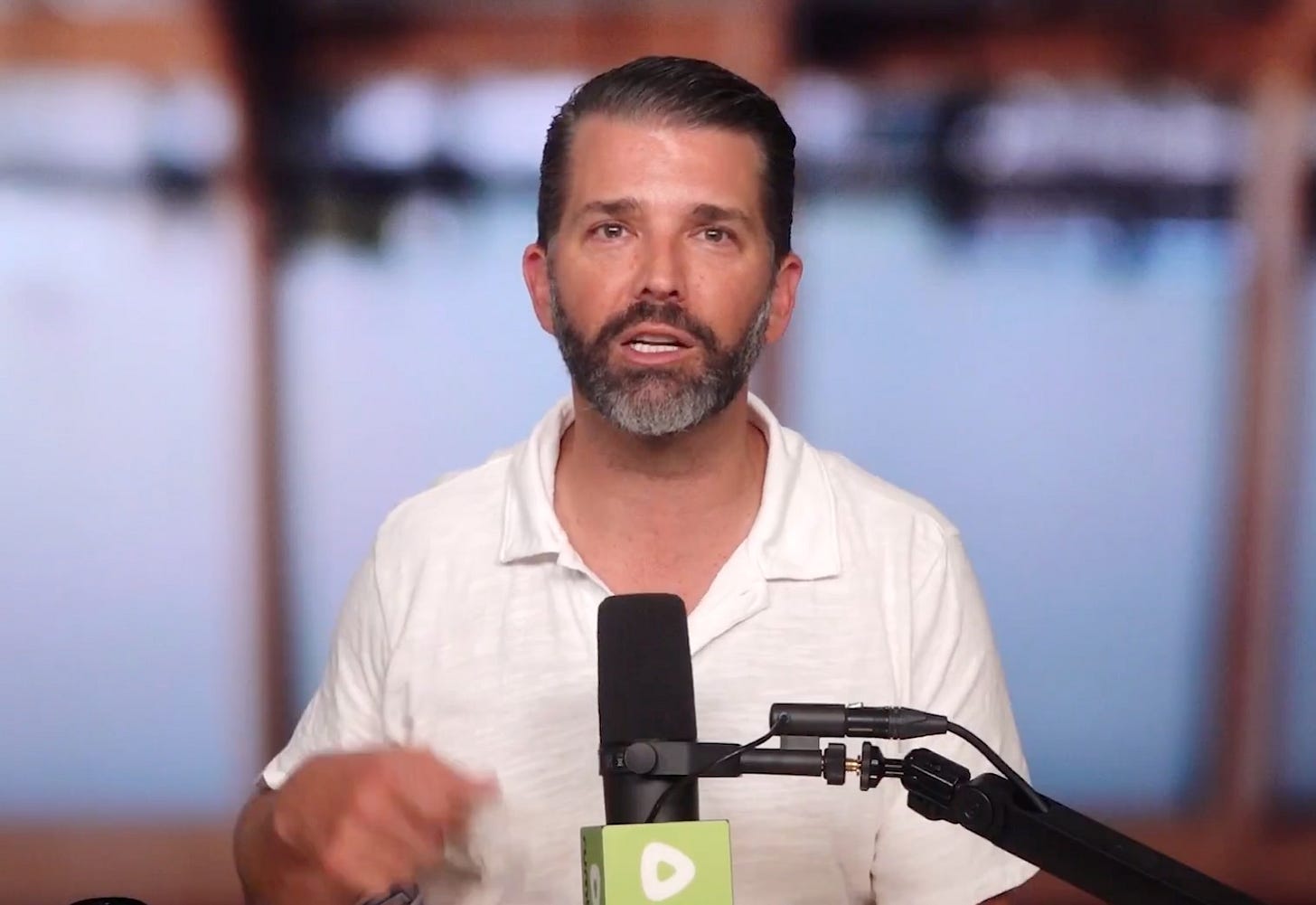

1789 Capital—a firm that lists Donald Trump Jr. as a partner, and also the company mentioned here in the December 18 post “Who Is Omeed Malik?” as a $15 million investor in Tucker Carlson—has attracted $500 million in investment since Inauguration Day, Bloomberg News reports.

“It’s aiming to collect $1 billion for its first fund by mid-2025 and then $3 billion to $5 billion for a second fund next year, according to a person familiar with the efforts. (1789 declined to comment on any of its fundraising plans.) Among the clients it hopes to woo: endowments and public pensions in Republican-controlled states,” the Bloomberg article reports.

The phrase “public pensions in Republican-controlled states” elicited a cackle here at The Editors.

If Hunter Biden were going around with a green-energy venture fund trying to get Governors Newsom to invest California state pension fund money, the House Oversight Committee and Rep. James Comer would be all over it. It’s not that investing in the conservative economy, as 1789 plans to do, is necessarily a poor economic bet—Fox News has been a huge business success. But if it’s going to be such a great investment, let it happen with private capital, not public pension money.

One-party rule tends toward corruption whether it’s Democrat or Republican, and it isn’t typically consistent with superior pension returns.

The New York State comptroller, Alan Hevesi, was sentenced to prison in a pay-to-play scandal that also featured civil SEC charges settled by Steven Rattner. The CEO of the California Public Employee Retirement System, Fred Buenrostro, was also sentenced to prison after a 2014 guilty plea to a conspiracy charge.

Some of our best friends and paying readers are honest and capable public-pension-fund executives and fund managers who accept public-pension money. But the ideal, principled, free-market reform here is to make the pension funds more like private individual retirement arrangements or 401k plans, where the investment decisions are made by individuals, not by politicians or their appointees.

Decentralized decision-making tends to be better—the wisdom of crowds. The Reason Foundation points out that “Public pension funds have consistently underperformed the S&P 500 and a 60/40 equity-fixed income benchmark over 5, 10, 15, and 20-year periods.” Allowing public employees to invest their own retirement income with defined contributions rather than have it invested for them with defined benefits gives the employee account holders more of a tangible, direct ownership stake in the success of capitalism.

Is America not polarized politically sufficiently already that we need also to have the Wyoming state pension fund investing in ammunition and Tucker Carlson, while the Vermont state pension fund invests in organic cannabis?

If there’s any upside of the whole situation, it may be that if Donald Trump Jr. is running a fund, it might potentially make President Trump less likely to follow through on his promise of “closing the carried interest loophole.”

Anyway, it’s not Donald Trump Jr.’s fault that his father is the president, and it shouldn’t prevent him from living his own life, including in the financial industry. The public markets have been down enough over the past few days that private equity, with less frequent marks to market, may look relatively attractive by comparison. But if any public employees in Republican-controlled states do eventually discover that their retirement funds have been invested for them in the Donald Trump Jr.-Omeed Malik 1789 Fund, they may find it one more bit of inspiration to exit government service—not for the gray area of state-pension fund capitalism, but for genuinely private free enterprise.

Bret Stephens joins the cut-capital-gains-tax parade: We’ve been writing here recently about the possible advantages of cutting capital gains taxes. See “One-Time Ten-Percent Capital Gains Tax Could Unlock Revenue, Growth” (March 3, 2025) and “Capital Gains Income Is Volatile, New Congressional Study Shows” (March 6, 2025). Now comes New York Times columnist Bret Stephens, March 10, 2025: “If the government is going to jack up prices through tariffs, which is one form of taxation, it should compensate with other types of tax cuts and not just by extending the current tax rates or cutting taxes on tips and Social Security benefits. How about deeper cuts on capital gains?” It is encouraging to see support snowballing for this idea.

General Avivi offers an update: Brigadier General (Reserve) Amir Avivi, the founder and chairman of Israel’s Defense and Security Forum, offered a video briefing from Israel of the sort that we’ve been sharing news of here on an ongoing basis. Today’s was a particularly provocative and direct one. Among the highlights:

Given that Hamas was responsible for kidnapping and killing Americans on October 7, 2023, why are its officials operating freely in Turkey, Egypt, and Qatar? “Put the leadership behind bars,” Avivi proposed. “Action is arresting all the leadership of Hamas.”

Avivi said Trump’s attempt to remove Russia from the axis with Iran and China benefits Israel and America. “The Ukrainians didn’t deliver. It seems like a dead end,” he said. He said the U.S. had sent so many munitions to Ukraine that it leaves the U.S. with insufficient munitions in case of a war.

He said Russia might served as a “stabilizing factor” in Syria, where “as we speak there is ethnic cleansing” and atrocities that look “like the seventh of October.” He said the people now in charge in Syria are “Isis on steroids…not the kind of guys you do business with.”

Avivi said he’d be at the White House next week. “We need the U.S. to attack, militarily, Iran,” Avivi said.

He said he is optimistic for Israel’s postwar future. “It’s going to be a golden age,” he said, predicting that Israel would attract millions of new Jewish immigrants.

To be clear I am not endorsing these points, just reporting them as newsworthy. Avivi was pressed on whether the U.S. abandoning Ukraine might send a message that is bad for Israel and he replied, “It’s all about real interests.” He also said it showed the need for Israel to “build our capabilities in ways that we can defend ourselves by ourselves.”

Avivi's assessment of the effect of the Ukraine situation on Israel sounds remarkably similar to what Naftali Bennett said at Harvard Chabad in response to my question: https://www.theeditors.com/p/generation-of-lions-will-usher-in-prosperity-israel-naftali-bennett-harvard-chabad-protest-business-school-prime-minister-israel-ukraine-russia

"Bennett’s take-home message about the Ukraine war was that there is a breakdown of the rules-based system of international affairs: Israel needs to be strong and self-sufficient in the chaotic new environment."