Capital Gains Income Is Volatile, New Congressional Study Shows

“More variable over time than other major sources of income”

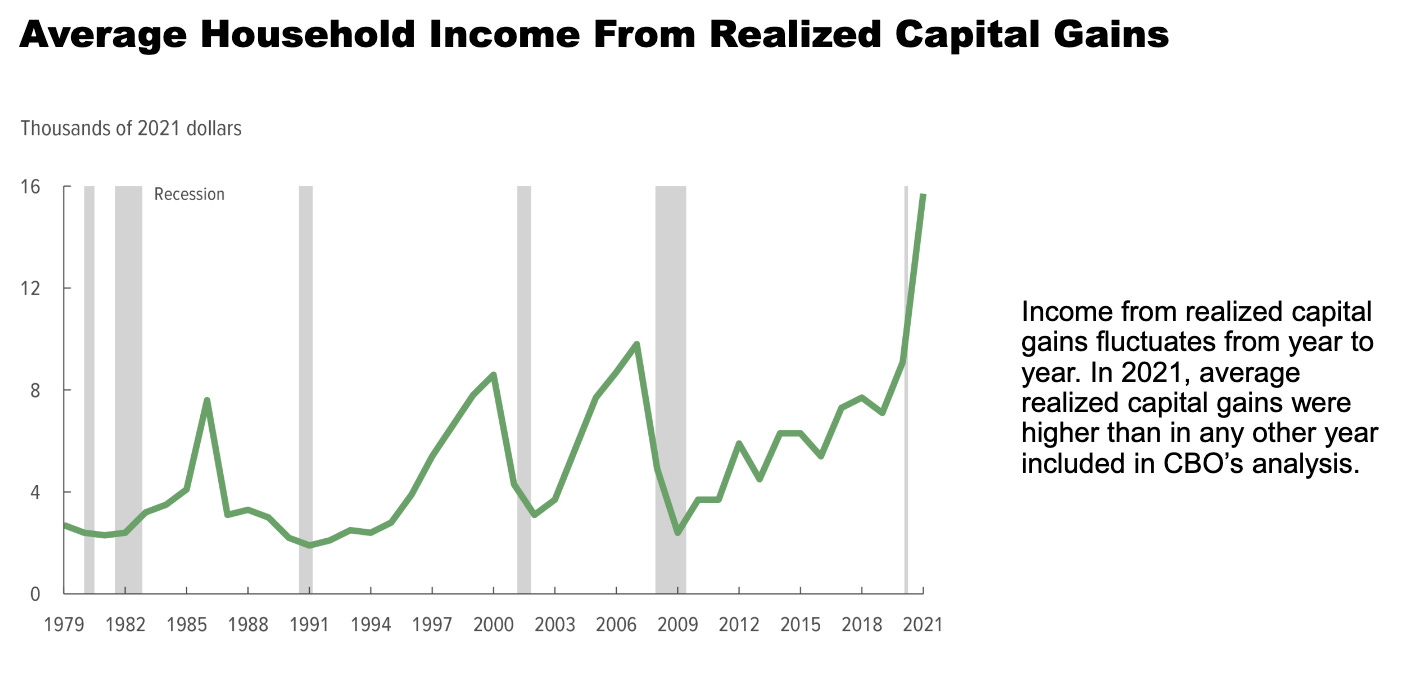

Just as I was preparing a follow-up post to Monday’s piece proposing a temporary 10 percent capital gains tax rate, an alert arrived from the Congressional Budget Office with new graphics and data supporting the general point that capital gains income varies widely from year to year in part because taxpayers frequently have some discretion about the timing when it comes to either realizing or deferring gains.

“Realized capital gains were historically high in 2021 and increased income inequality that year,” the CBO said. “In general, capital gains are more unequally distributed and more variable over time than other major sources of income.”

Monday’s article generated some useful feedback.

One sophisticated reader—okay, that’s redundant, there are no unsophisticated readers of The Editors—suggested that the same growth and revenue boom could be obtained simply by lowering the federal capital gains rate permanently to 15 percent. To my mind, if we’re debating 15 percent or ten percent on voluntary realizations, that’s already significant progress in comparison to the Biden-Harris-Wyden-Warren-Sanders approach of adding new mandatory taxes to be imposed even on unrealized capital gains. Talking about cutting taxes is better than talking about raising them (a principle visible now also in relation to tariffs, which are taxes on imports).

One tax lawyer for high net worth individuals, Philip Lindquist, commented, “The key is to have a deadline. I didn’t see my clients make a special effort to pay the 15% individual capital gains rate that began in 2003. But I saw extraordinary efforts made in 2012 before the rate went back to 20% in 2013. Deadlines and limited amounts focus the mind.”

An economics professor at George Mason University, Tim Groseclose, commented, “I think this could work. Suppose the govt. decreased capital-gains taxes to 10% but did it only temporarily, say for one year. I think Stoll is right: It would INCREASE govt. Revenue.”

A professor at George Mason’s Antonin Scalia Law School, David Bernstein, commented, “This is a brilliant idea. The key is that much of this revenue would not be borrowing from the future, because the gains will never be realized--the money will instead be transferred to heirs or to charitable foundations or to estate tax avoidance schemes.”

Another reader was confused about whether or how you could pay the tax and get the step-up in basis and still keep control or ownership. That’s a totally reasonable question. As I understand it, the idea is that an owner could have the option of selling everything or just doing basically a “deemed sale” in which you sell just enough to pay the tax on the whole thing, and get a new basis on what remains.

Anyway, the sooner Congress acts and provides some clarity and certainty on some of these tax and spending issues, the better. No one wants to rush anything through half-baked or attempt to do that only to discover belatedly that the votes are not there. But if the only tax action for the market and the media to fixate on is tariffs, the results will be what we are currently seeing, which is rocky.

Meanwhile, the Calafia Beach Pundit, Scott Grannis, has returned from a prolonged silence with a new piece titled “Near-term gloom, long-term boom.” Grannis concludes, “I remain an inveterate rational optimist: there are so many things that could be fixed for the better in this country!” His first graph is of the M2 money supply, “the most important financial variable that almost no one (including the Fed) pays any attention to.” Milton Friedman and his money manager Charles H. Brunie were both close watchers of the money supply. Neither of them are still with us, alas, but they are missed.

One worries that some of the recent increase in capital gains is due to a combination of:

⦿ Government spending heating up the economy, and

⦿ Inflation resulting from increased government spending.

An often-cited rationale for a lower rate for capital gains versus wage income is that part of the capital gain is due to inflation. But that proportion can vary widely for different investments and in different years.

I'd prefer a system in which capital gains are taxed at the same rate as wage income, but the gains are indexed to inflation. Decades ago this would have been difficult to do, but with the computerization we have now it could be accomplished without much difficulty.

One issue is that the inflation rate can be calculated in many different ways with different results, but even with the inevitable finagling there would be less distortion produced by the tax code than we have in our current system in which a bout of inflation can hugely exaggerate a capital gain.