Trump Parrots Biden’s Class Analysis

Plus, racial realignment; Israel’s ammunition; financial crises; ”happiness studies”

President Trump did a phone interview with CNBC this morning and in the course of it uttered the phrase, “the middle class largely built our country.” That is line that Biden frequently uses on the campaign trail, as in this January 24, 2024 appearance with the United Auto Workers: “Wall Street didn't build America. The middle class built America, and unions built the middle class. That's a fact.”

The thing about America is that these classes are not static—they are dynamic, with people moving between income levels over the course of a single career or in a family over generations. The divisions aren’t even that important. We’re not Britain where some people are “upper class” and others are “lower class.” This idea that “the middle class” are the heroes and everyone else is part of the problem—whether poor or rich—runs counter to the American idea, which is that “all men are created equal.”

The notion of Joe Biden—who with his wife earned $1,689,651 in 2018 from higher education institutions, and who has a 6,850-square-foot lakefront residence in Delaware as well as a $2.7 million beach house, and who earlier in his career lived in a 10,000-square-foot former DuPont mansion—as the middle class’s champion is kind of comical in its own right. How constructive it would be if there were a political candidate who instead of buying into or echoing Biden’s class-division nonsense, challenged it as divisive and contrary to the idea that we’re all in this together.

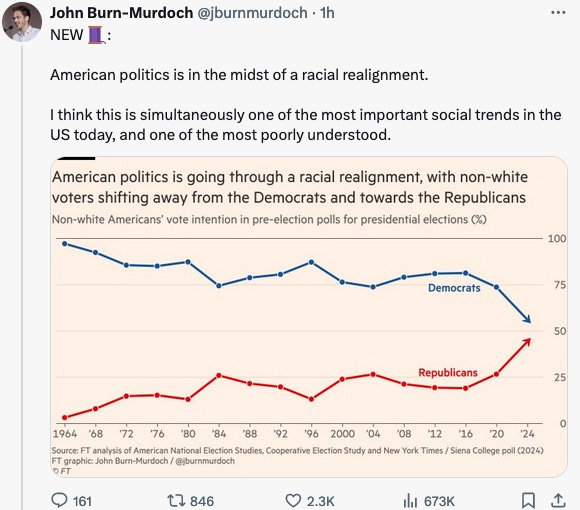

Racial realignment: In the Financial Times, John Burn-Murdoch has a humdinger of a column about how American politics is going through a racial realignment. “Many of America’s non-white voters have long held much more conservative views than their voting patterns would suggest. The migration we’re seeing today is not so much natural Democrats becoming disillusioned but natural Republicans realising they’ve been voting for the wrong party,” he writes.

“As the US becomes less racially segregated, the frictions preventing non-white conservatives from voting Republican diminish.”

He concludes: “To be clear, nothing in politics is guaranteed. Some shifts are temporary, and many of those deserting the Democrats will become swing voters rather than solid Republicans. They can be won back. But the left’s challenge with non-white voters is much deeper than it first appears. A less racially divided America is an America where people vote more based on their beliefs than their identity. This is bad news for Democrats.”

Trump must be thinking about this in the context of his vice presidential choice. There’s lots of speculation about him picking a woman, but it’d also make some sense for him to look for a black or Hispanic running mate who might accelerate these trends. He wouldn’t want to make Biden’s mistake of getting boxed in with a promise to fill a job with a member of a particular demographic.

If you look at this not from a narrow partisan perspective of what’s best for Republicans or Democrats but from a broader perspective of what’s best for America, it’s a healthy development that political choices of minority groups aren’t the outgrowth of crude racial determinism, and that both major parties have substantial representation.

The FT is catching up with Jason Riley and William Galston in the Wall Street Journal and with me at the Editors and at FutureOfCapitalism, but it’s such a significant point that it’s worth mentioning. And the FT did a nice job with the graphics.

Israel waits for ammunition resupply: Elliot Kaufman has a piece in the Wall Street Journal from Tel Aviv that I found definitely worth my time. News to me was the explanation for the delay in pressing on to victory against Hamas in Gaza in Rafah: “Israel needs time to prepare a plan to evacuate civilians and to muster the necessary ammunition. (A senior political official says, ‘Israel has enough ammo for victory but not for comfort.’)… Israel is planning for Rafah and seeking and producing ammunition.”

My understanding had been that the plan to evacuate civilians is done already and is not that complex—Israel already moved many of these civilians 40 kilometers from northern Gaza to southern Gaza; moving them a second time toward the beach from Rafah is less complex than what was already accomplished. The ammunition angle, though, was a bit of a surprise.

Going forward, Israel is going to be trying to make as much of this material as possible domestically rather than relying on imports from America or elsewhere, which are seen as less reliable. The war could last longer than is widely appreciated or understood in America. Even if peace comes unexpectedly quickly, Israel will have a newly increased desire to stockpile large quantities of weapons and ammunition. That might suggest that Israel-based arms manufacturers such as, say, Elbit Systems, are worth a look.

“The Puzzling Persistence of Financial Crises,” made less puzzling: Charles Calomiris of Columbia Business School and Matthew Jaremski of Utah State University are out with a new working paper from the National Bureau of Economic Research headlined, “The Puzzling Persistence of Financial Crises.”

They look at 10 crises as part of a bigger project to try to develop a “crisis taxonomy.”

“Looking through the existing literature, four broad categories stand out for explaining why risk sometimes becomes suddenly repriced,” they write. “Politically motivated risk subsidies can skew incentives.” “Second, investor preferences or exogenous market influences (e.g., the riskless interest rate set by the central bank) can shift in ways that affect risk pricing.” “Third, it takes time for investors to learn about new innovations and markets.” And, “Finally, another broad category of explanations for sudden changes in perceived risk is fraud.”

They conclude by explaining that crises “are one of the costs we pay for adaptive social constructs like national sovereignty, capitalist growth and representative government.” Or, to put it another way, “Crises persist, despite the fact that they are costly, because they are connected inextricably to important elements of economic progress and political sustainability: learning about new opportunities, improving a nation’s ability to compete with other nations, and satisfying political constraints imposed by powerful constituents.”

“Self-Reported Misreporting”: There’s been a boom in the academic field known as “happiness studies,” with Arthur Brooks at Harvard, Laurie Santos at Yale, and a rotating crew at the University of Maryland fielding popular courses and bestselling books. Perhaps inevitably, we’re starting to see something of a pushback. The latest example comes in a new working paper from the National Bureau of Economic Research by James Andreoni of University of California, San Diego; B. Douglas Bernheim of Stanford, and Tingyan Jia of the University of Leicester. It is headlined, “Do People Report Happiness Accurately?”

As they point out, “Validation of happiness measures is inherently challenging because subjective sensations are unobserved.” In other words, “true happiness is unobservable.” The economists try to measure how much people are lying about how happy they are by surveying them, developing a measure they call “self-reported misreporting.” Alas, “there is no simple pattern such as consistent overstatement, understatement, or compression.”

Their conclusion: “considerable caution is warranted when interpreting studies that attempt to infer how conditions affect welfare by analyzing measures of self-reported well-being.” That’s not to say that all of “happiness studies” is nonsense. It is to say, though, that it makes sense to remember that self-reported happiness on a survey may well be something different than actual, genuine happiness.

Thank you!: Welcome to all new readers and paying members. I appreciate your being here. We have been at this at The Editors for less than a week and have been seeing encouraging growth. If you find this valuable, please share it by forwarding the email to friends with a suggestion that they sign up.

Financial crises may persist because on August 15, 1971 President Nixon closed the gold window.

This enabled the U.S. Government to run larger deficits, which in turn lead to financial instability.