Treasury Secretary Bessent on Interest Rates, the Budget, and Growth

Plus, new filings and a judge’s order in Kestenbaum case against Harvard

The Treasury secretary, Scott Bessent, did an interview recently with the “All-In Podcast” that was illuminating on several fronts.

First, he’s aiming for higher growth and hoping that will improve the federal budget picture: “Tax cuts and deregulation will change the growth trajectory... grow GDP. If trend line has been 1.8, if you can move the growth to three or above, then you really change their trajectory. And if you can keep expenses flat or do the unthinkable and cut expenses, then you can really...”

Second, he understands the linkage between interest rates and the federal budget: “We might actually pull Treasury bill yields down by 30 to 70 basis points. Every basis point is a billion dollars a year.”

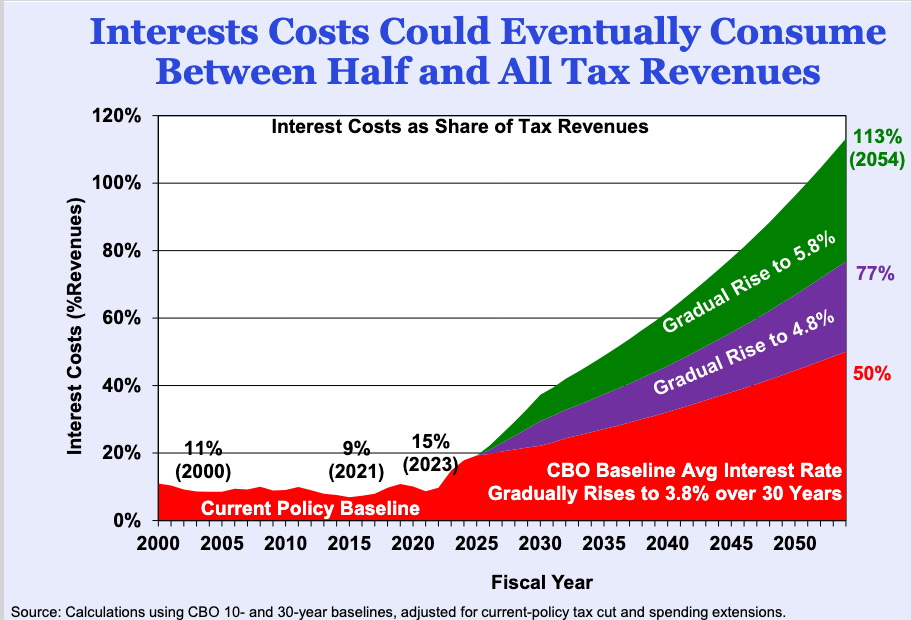

As I wrote recently (“Maybe Trump Is Intentionally Creating a Mini-Recession,” March 13, 2025), “with interest rates where they are, the cost to the Treasury of simply rolling over existing debt is staggering. It doesn’t leave tax cutters much room to operate, even taking into account the dynamic growth effects of the tax cuts. A deficit or tax cut that looks affordable at three percent interest rates becomes more difficult, or impossible, at four and a half or five percent interest rates.”

The Manhattan Institute has a series of charts quantifying this:

Third, Bessent is quoting…well, here it is: “here's another great macro investor called Bruce Kovner, and he had this saying that he said, I succeeded because I could imagine a different future and believe it could happen.” I take it as an encouraging sign that Bessent is out there publicly citing Bruce Kovner.

There’s a lot of arcane material in the podcast about banking deregulation and housing and energy. Anyway, we’ll see whether it all works out or whether it doesn’t, but the Bessent podcast is a good counterbalance to the impression you might get from reading the newspapers, which is that the Trump administration is dumb or crazy. Bessent doesn’t appear to be either of those things.

Kestenbaum case developments: Judge Richard Stearns of the U.S. District Court for the District of Massachusetts issued an order Friday granting anonymity to two current Harvard graduate students who aim to join 2024 Divinity School graduate Alexander “Shabbos” Kestenbaum’s antisemitism lawsuit against the university.

Thursday and Friday saw a flurry of filings from both sides. “John Does are Jewish students at Harvard Business School (“HBS”) and Harvard Law School (“HLS”). There, they have endured severe antisemitism, including in the form of severe harassment, bullying, public shaming, doxxing, and retaliation by students, faculty, and administrators,” a memo in support of their motion to proceed pseudonymously said. “Anonymity is warranted because John Does have already been subjected to the most serious harassment and retaliation, and they continue to be severely mistreated to this day. Public disclosure of John Does’ identities would therefore expose them to even more retaliation and harassment.”

“Harvard opposes the Motion—which itself is indicative of Harvard’s disregard for the privacy and safety of its Jewish students and demonstrates why relief is necessary. Harvard’s opposition is not only inconsistent with its prior litigation position in this case, but it also exposes that Harvard has no desire to protect its Jewish students when it serves its interests. By contrast, after October 7 and the ensuing antisemitic fervor on campus, Harvard’s first step was to protect the antisemitic protestors,” the memo says.

A March 21 memo from the Harvard Business School student seeking to join the suit says, “I continue to be subjected to antisemitic harassment on Harvard’s campus, and the revelation of my personal identity in this proceeding would significantly escalate this harassment, potentially leading to more violence. I have already been physically attacked due to my Jewish and Israeli identity, and I fear that the revelation of my personal identity in this proceeding would further jeopardize my physical safety.”

Harvard, meanwhile, filed a court document attacking Kestenbaum as a publicity hound: “He has chosen to use his status as a plaintiff against Harvard to amplify his presence on social media, while neglecting his actual, considerably narrowed, legal case.” Harvard’s lawyers also tried to use an out-of-context quote from the Harvard Hillel director to undercut the claims by the Jewish students. “Harvard Hillel Executive Director Rabbi Jason Rubenstein praised Harvard’s actions in the weeks after the settlements, ‘celebrat[ing] … ‘a type and pace of change’ that he would not have anticipated.”

“The time has passed for Mr. Kestenbaum to boast about his lawsuit while refusing to engage in his responsibilities as a litigant. Having risen to fame as an ‘American suing Harvard,’ he must now decide if he is actually willing to engage in the litigation that launched his public persona,” said the March 21 court filing by Harvard’s lawyer Felicia Ellsworth of WilmerHale.

The Harvard filing claims Kestenbaum “decided to continue litigating against Harvard despite the historic settlement agreements Harvard reached with every other plaintiff.” Yet, Ellsworth’s claim notwithstanding, Harvard did not settle with “every other plaintiff.” A current law student and a current business school student have refused to settle and are seeking to join Kestenbaum’s suit as John Does—a status it appears Judge Stearns has now okayed.

Addition of the 2 current students to the Kestenbaum lawsuit also protects against the lawsuit being declared moot because Kestenbaum has graduated.