To Make Next Shutdown Less Disruptive, Move Functions out of D.C.

Plus, New York Times misfires with front-page attack on “abusive” Bessent “tax dodge”

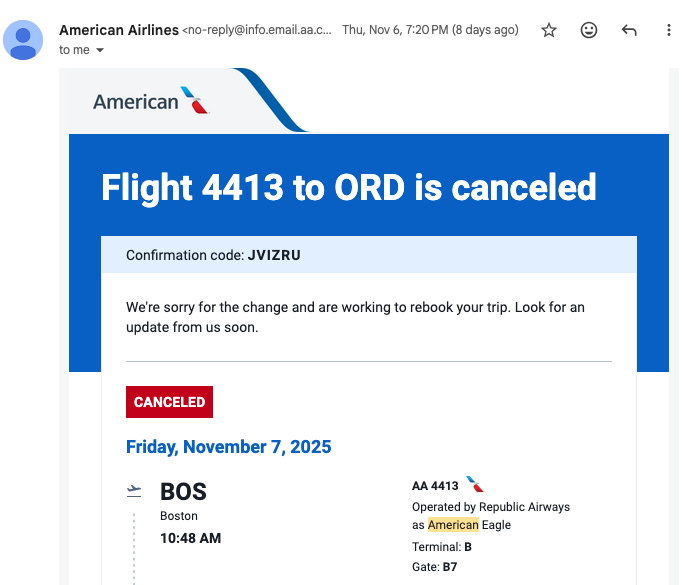

“Your flight to Chicago O’Hare - Canceled,” was the subject line of the email I got last Thursday night notifying me of the news that, because of Washington dysfunction, I wouldn’t be able to have a Friday night dinner that I had been looking forward to.

As a new victim of the government shutdown, I counted myself angry, though lucky compared to workers who are missing paychecks or poor people whose Supplemental Nutrition Assistance Program money did not show up on time. Almost as disappointing as the canceled flight was been the way the public discussion of the shutdown has focused narrowly on partisan political advantage while missing the bigger point, which is that a country so dependent on Washington politicians for so many things puts itself at risk.

The government shutdown makes a case for smaller government, one in which tasks now nationalized are instead distributed to state and local governments or the private sector. That way, when Washington grinds to a halt, there’s less damage.

As usual, the politicians blamed each other for the impasse. Even the political polling bought into that dichotomy, a blame game. “In thinking about the government shutdown, who do you think is more responsible: Republicans in Congress or Democrats in Congress?,” asked a Quinnipiac University Poll of 1,327 self-identified registered voters nationwide, fielded October 16 to 20, 2025. Eleven percent of respondents volunteered that they blamed both parties.

An NBC News survey of 1,000 registered voters conducted October 24 to 28, 2025 approached the issue the same way, asking, “As you may know, President Trump and the Democrats in Congress have not reached a budget agreement, and this has led to a partial shutdown of the federal government. Who do you think is more to blame for this partial shutdown -- (RANDOMIZE) President Trump, the Republicans in Congress or the Democrats in Congress?” Four percent of respondents volunteered that they blamed all of them.

Better than arguing over who is to blame would be fixing the system so that when the politicians disagree the next time around, the disruption is less.

That could mean moving air-traffic control to the private sector. Canada, not exactly a free-market utopia, privatized its air-traffic control system in 1996. Presidents from Bill Clinton to Donald Trump have moved in that direction without actually making it happen. If they had, the air-traffic controllers would be reliant on airline passengers, not Washington politicians, for a paycheck, and maybe my flight to Chicago would not have been canceled.

Likewise, federal nutrition assistance could be replaced by programs of state and local governments. There’s no decisive constitutional or practical reason for nutrition assistance to be a federal program rather than a state or local one. States including Pennsylvania, Alabama, Alaska, Arizona, and Massachusetts stepped in with money to replace federal nutrition aid. In Boston, where I live, bakeries and farmers alike generously donated to help hungry neighbors. Charitable Americans have been feeding the hungry since long before the Food Stamp Act was passed in 1964, and even that act included a role for states in setting eligibility standards.

Sure, plenty of state and local governments are also corrupt or dysfunctional. At least when they break down, though, the damage is usually confined, or directly visible enough that it generates a corrective response.

And some powers, such as declaring war or coining money, are constitutionally with the federal government for good reason. The Washington shutdown is a reminder of our founders’ genius in making those enumerated powers a limited list. Decentralized systems are more resilient and more responsive. Had air-traffic control been privatized already, I, and tens of thousands of other travelers, might be at our destinations safely rather than fuming at a federal failure. Washington politicians are typically reluctant to surrender control over anything. If they take a different approach this time, the next shutdown, when it comes, may be less painful.

New York Times misfires with front-page attack on Bessent “Tax Dodge”: The top-of-the-front-page attack on the Treasury secretary, Scott Bessent, for what the Times calls a “tax dodge” allowing him “to skirt self-employment taxes” is a misfire even by the low standards of New York Times hit pieces on effective and successful Republican officeholders.

The Times explains that “Most Americans steadily pay into Social Security and Medicare through taxes that are withheld from every paycheck. But many wealthy Americans who own businesses can avoid these taxes by directing earnings through limited partnerships or several other types of business entities.”

The whole breathless Times article makes it sound like Bessent has done something wrong.

The first named quote in the Times article is this:

“There’s zero question that this is abusive,” Walter D. Schwidetzky, a law professor at the University of Baltimore who focuses on partnership taxes, said of the ability for business owners to avoid self-employment taxes through limited partnerships. “No one of good faith would argue otherwise.”

I’m of good faith, and I am arguing otherwise. The University of Baltimore is a government-controlled law school in Maryland. It gets money from taxes. Its professors are employees who earn W-2 income. Schwidetzky also writes for Tax Notes, which, because it is part of a “nonprofit,” Tax Analysts, in which the profits are paid out as employee compensation, is exempt from federal income tax. (Some Treasury secretary might want the IRS to take a careful look at Tax Analysts). So you have a guy who works for two institutions that pay no income taxes complaining that it is “abusive” that Bessent didn’t pay even more income tax than he already did.

Federal election records show eight campaign contributions by Schwidetzky, all of them to Democrats. The Times doesn’t tell readers that.

Do they teach Helvering v. Gregory at the University of Baltimore Law School? That’s the 1934 case in which Judge Learned Hand wrote, “Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.” (Also cited by Justice O’Connor in a 1994 concurrence.)

(There was another law professor who wrote for Tax Notes who taught at a public law school—maybe one of the U.C. ones—who made a career out of campaigning incessantly for higher taxes on carried interest, another campaign that the New York Times gave excessively credulous treatment to.)

If the Times—which itself is structured with ownership by family trusts both to minimize taxes and maintain family control at minimal economic cost—wants to change the tax law, it can write editorials or hire a lobbyist to convince enough congressmen to change the law. Until then, business owners and partners have some latitude to set levels of income that are fixed or “guaranteed” and other levels that are variable or at risk. The tax law treats those sorts of income differently. People who have not been business owners—a category that includes a lot of law professors and newspaper reporters—have a hard time wrapping their heads around this. But it’s the law, and it applies not just to partners in hedge funds like Bessent but also to all sorts of other small businesses that are organized as partnerships—law firms, accounting firms, Bloomberg L.P. Does the Times think Mike Bloomberg pays Medicare tax on all his Bloomberg income?

The Times reporter on the story, Andy Duehren, seems to have worked at the (nonprofit) Harvard Crimson, the Wall Street Journal, and the New York Times. His LinkedIn profile doesn’t show that he’s ever started a business or been a partner in one.

The fact that the Biden-era IRS was trying unilaterally to change these rules to collect more taxes doesn’t change the reality. What’s really “abusive” is subjecting people such as Bessent, who volunteer for public service, to these sorts of hit pieces. We’d get better tax coverage—better business coverage generally—if before working as a salaried reporter these reporters had to spend a year or two trying to run a small business and dealing with all the bureaucratic hassles and taxes.

Thank you: The Editors is a reader-supported publication that relies on paying customers. Unlike the parent of Tax Notes, we are not a nonprofit, and unlike the University of Baltimore, we aren’t funded by taxpayers. If you know someone who would enjoy or benefit from reading The Editors, please help us grow, and help your friends, family members, and associates understand the world around them, by forwarding this email along with a suggestion that they subscribe today. Or send a gift subscription. If it doesn’t work on mobile, try desktop. Or vice versa. Or ask a tech-savvy youngster to help. Thank you to those of who who have done this recently and thanks in advance to the rest of you.

Did the NYT article point out that Biden got around paying tens of thousands of dollars of Medicare taxes by claiming very little salary in his pass-through business where he was the only employee and the only stockbroker while he brought in millions of dollars? The IRS publicly declined to audit Biden on this precise issue probably because he was the President and because so many others do the exact same thing. The challenge is in defining what is a “reasonable” salary. However, when your business which consists of no one other than yourself is bringing in millions and you are claiming a salary of only around or under the social security wage ceiling, you are clearly cheating the Medicare system out of legitimate tax revenue, as Medicare taxes have no wage ceiling. To claim a relatively low salary when the business consists of nothing other than one person in all respects, is to engage in Medicare tax evasion, and should be treated accordingly.

Schwidetzky and Duehren earned Masters Degrees from the You-Didn't-Build-That School of Economics.