The New York Times Company Is No Longer a News-Only Business

No wonder its stock just hit a record high while Israel mulls a lawsuit

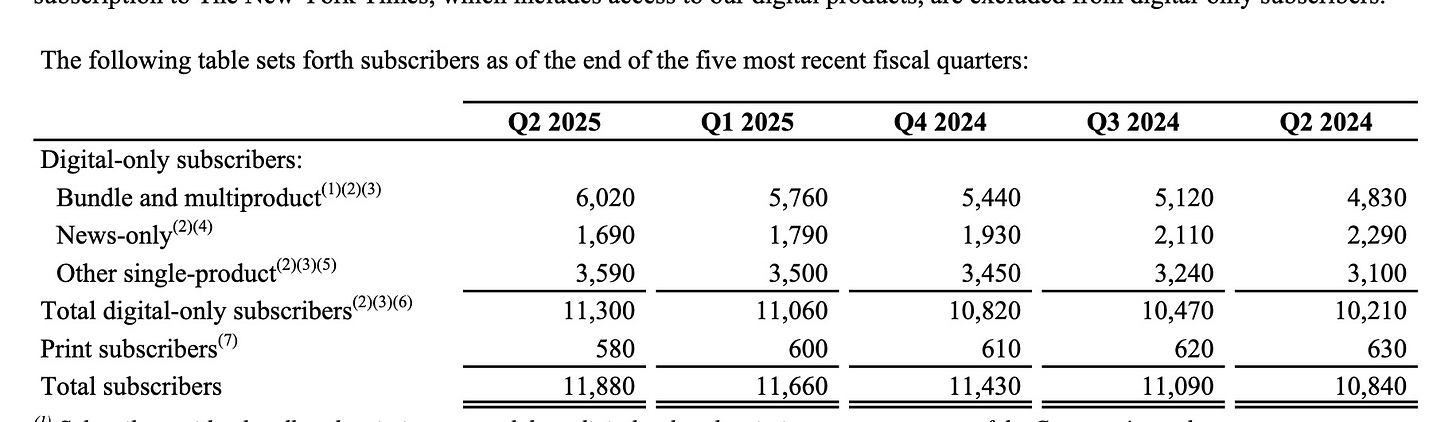

The New York Times Company stock hit a record high earlier this week after a second-quarter earnings release in which the Times says it had brought its “total number of subscribers to 11.88 million.” But beyond the headline subscriber number and the soaring stock price is a more complicated story with some underappreciated risks. Here are the full details:

The Times doesn’t say how many of those customers are in the U.S. versus elsewhere [update: at year-end about 20 percent were “international”]. One breakdown it does provide, though, came in small print on page 13 of the 20-page earnings release.

It shows that “news only” digital subscriptions to the Times declined to 1.69 million in the second quarter of 2025 from 2.29 million in the second quarter of 2024. In other words, of the nearly 12 million subscribers of which the Times boasts, a mere 14.2 percent of them (19.1 percent if you add print subscribers) are just there for news. The rest of them are there for other things, too, or for other things, only.

In a quarterly investor call, Times executives were direct in communicating that story.

“Our world class news coverage and diverse portfolio of lifestyle products in big spaces are continuing to attract large audiences who engage deeply,” the Times Company CEO, Meredith Kopit Levien, said. She talked about “having a portfolio of compelling brands in spaces with broad marketer appeal, particularly sports and games.”

“We’re using video much more extensively to enhance the experience across our lifestyle products, including sports highlights from major leagues on the Athletic and new video franchises on Cooking,” she said. “We’ve got extraordinary apps, particularly our core news app, and also now our games app, our Cooking app, the Athletic app.”

Existing Times shareholders have prospered as the company’s valuation has started to look more like a mobile technology company than a news or newspaper company. But while the expectation of, and, to some extent, the reality of, revenues from games, sports, and cooking, or of artificial intelligence deals, has helped ease cost pressures on the Times newsroom, the change has the potential to affect the Times in ways that could pose perils in addition to the profits.

For the newsroom, it’s a risk to be supported by profits from customers who aren’t primarily interested in the product you are producing. Remember all those years when newspapers were supported by classified ads for help-wanted, rental apartments, and used cars? When that business disappeared elsewhere, the newsrooms were hollowed out. A newsroom’s best defense is the argument that if an owner reduces the quality of the news, customers will be less willing to pay. But if the customers are there for the games or the recipes, it’s harder to defend and justify the spending on foreign bureaus or investigative editors and reporters in Washington. If most of the subscribers are really there for the games and the recipes, the temptation, in a recession, to pare back the news coverage will be strong.

It also may, paradoxically, create some instability in the capital structure of the company, where the Ochs-Sulzberger family maintains control through trusts and classes of stock with special privileges that exceed those of the shares that non-family-member investors can acquire.

Traditionally the worry has been that if the company does poorly and cuts dividend distributions, the family members who don’t work there might get impatient. They could decide that the family should surrender control, and invest the fortune elsewhere, in more promising and lucrative industries and ventures.

But there’s also a risk that if the Times company does too well, the family could conclude that, rather than providing a public service by stewarding a newsroom, they are creating a valuation drag on a high-tech business that has little or nothing to do with news. Then the Ochs-Sulzbergers might do what the Graham family did when it sold the Washington Post to Jeff Bezos—split the low-margin, high-cost news business off from the more promising non-news business. In the case of the Times, this might allow shareholders a choice about which businesses, if any, to continue owning. Critics might see it as financial engineering, but Wall Street would call it unlocking shareholder value.

There’s another reason lurking in the background that might justify splitting the high-growth non-news Times businesses from the old guard “news only” operation. Prime Minister Netanyahu told Fox News this week, “the New York Times should be sued. I am looking whether a country can sue The New York Times. I am looking into it right now. I think it is such clear defamation.” The New York Times responded with a press statement that asserted, without reliable evidence, “children in Gaza are malnourished and starving.” It went on, “attempts to threaten independent media providing vital information and accountability to the public are unfortunately an increasingly common playbook.” How “independent” the Times journalists are is an interesting question, given that Times Jerusalem bureau chief Patrick Kingsley has acknowledged, “Hamas restricts journalists in Gaza.”

If the Times Cooking and Games and Athletic and Wirecutter apps are really worth billions and attract tens of millions of subscribers, why not put them in a corporate entity not subject to the whims of jury defamation verdicts? I understand the Times has good lawyers and lots of insurance, and I understand that current U.S. law makes such cases difficult to win. But why even take the risk? The more lucrative the non-news New York Times businesses are, the deeper pocket they are for potential trial-lawyer plaintiffs, and the greater the urgency of protecting them from the risk of some outsized verdict in bet-the-company litigation. If the Times has sophisticated investment bankers and independent directors who are attuned to their fiduciary responsibilities, these are questions that will be asked in the months and years ahead.

Know someone who would enjoy or benefit from reading The Editors? Please help us grow by forwarding this email along with a suggestion that they subscribe. Or send a gift subscription:

The study to which Ambassador Huckabee referred is the subject of a WSJ op-ed by one of its authors: https://www.wsj.com/opinion/how-humanitarian-aid-feeds-war-machines-support-hunger-suffering-44a85d94?st=ySy1cf&reflink=desktopwebshare_permalink

The study is at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5380004

With respect to the NYT stock situation I thought that they were a fertilizer manufacturer just based on the amount of bullshit that they produce.