The $2 Trillion Deficit

Plus, Trump’s Iron Dome; Jewish and Palestinian genes

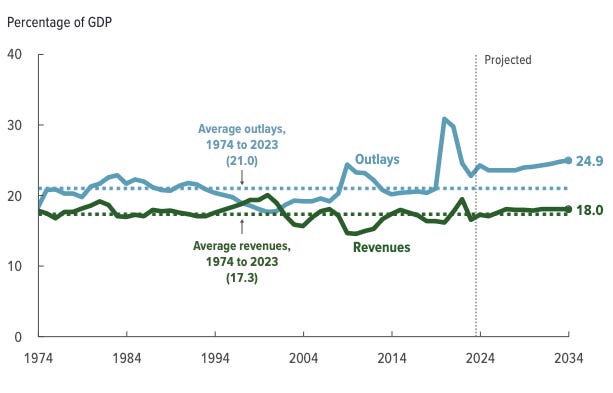

The Congressional Budget Office today released an update to the budget outlook, projecting a $2 trillion deficit for 2024, or about 7 percent of GDP. “Measured in relation to economic output, federal debt held by the public rises from 99 percent in 2024 to 122 percent in 2034, surpassing its historical peak. Then it continues to rise,” the CBO director, Phillip L. Swagel, said in a statement summarizing the update.

Swagel said the deficits this year and those projected over the next decade “are large by historical standards.” He said the growth in spending is driven by interest costs and “greater spending on programs that benefit older people, including Medicare and Social Security. Spending on those benefits rises because of the aging of the population and growth in federal health care costs per beneficiary.”

The longer-term projections are not that dependable because they rely a lot on assumptions about economic growth, inflation, interest rates, and unemployment rates. But the spending numbers are reliable. They include: “A $145 billion increase in projected outlays for student loans stems mostly from revisions that the Administration made to the estimated subsidy costs of previously issued loans and from the Administration’s proposed rule to reduce many borrowers’ balances on student loans.” Some of that is spending that Congress arguably didn’t even intend to approve, but that Biden is doing by executive action (Biden claims a law authorized the loan forgiveness, but the last time Biden made such a claim, the Supreme Court said it was not justified).

The news prompted scattered expressions of concern from some members of Congress. “This is a bipartisan effort brought about by D.C.'s irresponsible habit of governing by spending,” Rep. Nancy Mace, a Republican of South Carolina, said in a social media post.

Senator Mike Braun, a Republican of Indiana, said, “I wrote a balanced budget. It can be done! Just need some backbone in Congress to stop the spending.”

As the chart shows, revenues as a percent of GDP are running roughly in line with, or slightly above, average, but spending is running way above average. That could help to explain some of the inflation.

The Paul Ryans, George Wills, Pete Petersons, and Ross Perots of the world have been warning about these deficits and debt problems for so long that people’s eyes glaze over and start to wonder whether it’s really a problem. The politics of it are that no one wants to “cut” or be accused of cutting popular programs such as Social Security or Medicare to achieve the abstract accounting achievement of a balanced budget. Bill Clinton and Newt Gingrich got a balanced budget from 1998 to 2001 and it wasn’t quite enough to get Al Gore elected president in 2000.

If Trump can make a case that the deficit is hurting ordinary Americans by fueling inflation, or that the spending is corrupt because Biden is using it to buy votes by directing it at politically favored crony constituencies (“Green” energy investors, student loan recipients who work for activist left-wing nonprofits), he might be able to get some traction on the issue. Or he might be able to use it to depict Biden as the real authoritarian: Okay, Crooked Joe Biden says democracy is on the ballot? Biden is the same guy who just added $145 billion to the deficit without getting permission from Congress, and created a more expensive government in Washington than we’ve had in generations.

Beyond the politics, the deficit and debt in non-crisis periods impose some constraints on the ability of politicians to react in the case of a new crisis. Suppose Iran or China attacks and we wind up in a war. Or suppose there’s another financial crisis, unemployment soars, and tax revenue plummets while demand for food stamps, Medicaid, and unemployment benefits soar. If there’s a $2 trillion deficit amid relative peace (okay, not in Israel or Ukraine, but still) and prosperity (okay, it may not feel like prosperity, but the reported unemployment rate is low), imagine what the federal budget gap will look like in a war or a recession. And what happens if and when those lending money to the government eventually demand even higher interest rates in return for the risk of a default or inflation? The smart move would be to narrow the deficit now and reduce the longer-term dangers. It’d require a level of political leadership and courage that is rare.

Trump’s Iron Dome: Speaking in Racine, Wisconsin, this afternoon, President Trump made his usual attacks on President Biden for illegal immigration and for inflation, and then added some new language on missile defense.

“We will build a great Iron Dome over our country,” Trump said. “We’re gonna build the greatest dome of them all.”

“We’re gonna build a dome, a safety shield over the top of us,” Trump said. “All made in the U.S.A.”

As Trump noted, this was a Reagan idea whose usefulness and technical feasibility was demonstrated during the recent Iranian attack on Israel.

America already has some missile defense in place, but we sure could use more and better, so this is a welcome substantive positive theme to see in a presidential campaign that so far has focused mainly on the negative case against Biden.

There’s some danger that with Trump or some of Trump’s more isolationist-leaning acolytes (Senator J.D. Vance), the missile defense could substitute for a forward strategy aimed at defeating the enemies. The real danger, after all, isn’t merely the missiles or drones, but the combination of the missiles and drones and a hostile regime. But America will be in a better position to defeat the Chinese Communists and the Iranian terrorists, or to help the Iranians and Chinese liberate their own countries, if we have a defense in place.

Jewish genes are Middle Eastern: Genetic evidence shows Jews are indigenous to the Middle East and related to Palestinian Arabs, Dr. Michael Segal writes at JNS.

“As genetic testing is used more widely to diagnose rare diseases, the awareness of shared genetic variants among Jews and Arabs is increasing among physicians. However, such genetic evidence is rarely discussed publicly. Arabs are reluctant to make clear that Jews are indigenous to Israel and Jews are reluctant to discuss the fact that many Palestinian Arabs have some Jewish ancestors,” he writes. “Once you know that many Palestinian Arabs are descended from Jews, an eventual reconciliation between Palestinian Arabs and Jews becomes easier to imagine, though such reconciliation seems far from imminent.”

The whole piece is worth a look. My own view of it is one reason God created Adam and gave us the biblical story of it is to remind us that we’re all descended from a common ancestor and share a common humanity and status of being created in God’s image. And Judaism is different because there’s no genetic test—you can convert in, and those who have, and their descendants, are no less authentically Jewish or Israeli than anyone else, as the biblical story of Ruth (great-grandmother of King David) reminds us.

Group subscriptions: As of this week we have the first group subscription up and running here at The Editors. Welcome to the ten new readers and thanks to the sponsor. If you’d like to buy a group subscription for your nonprofit organization board, the other reporters in the Washington bureau, the other faculty members in your department, or the entire staff of your family office, this link should work. There’s a volume discount. Thank you!

So how did Bill Clinton and Newt Gingrich get balanced budgets from 1998 to 2001? They are both still around. What do they advise now?

Is there a lawsuit to stop Biden from adding $145 billion to the deficit without getting permission from Congress (student loans)?