Ken Griffin’s Deficit Warning

Plus, a challenger for Elizabeth Warren, good news from Israel, the rideshare boom

Citadel founder Ken Griffin is warning about federal debt as a “growing concern that cannot be overlooked.”

Bloomberg reports:

Griffin said net interest spending is estimated to reach 3.1% of gross domestic product for 2023, citing Congressional Budget Office estimates.

That’s a percentage point more than the average from 1974 to 2023, the letter said.

“It is irresponsible for the US government to incur a deficit of 6.4% when unemployment is hovering around 3.75%,” Griffin said in the letter. “We must stop borrowing at the expense of future generations.”

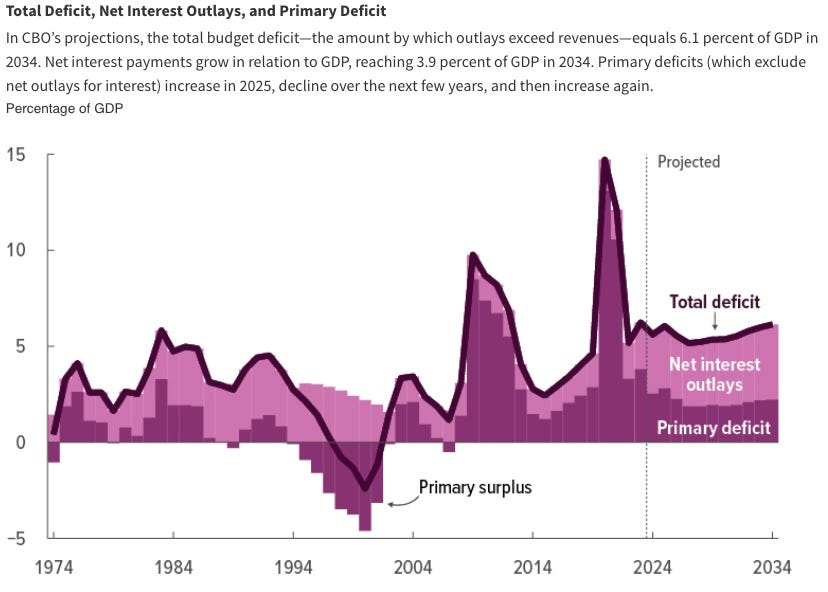

Here is a figure from the Congressional Budget Office showing how interest on the debt is projected to soar as a share of GDP.

That is based on the assumption that the Fed cuts interest rates soon. The longer the Fed doesn’t cut, the higher the interest payments stay for longer, and the uglier the federal budget picture looks going into the November election and afterward. Presumably Jerome Powell understands this, which may be one more reason a lot of people expect him to cut.

Not that interest rates are the dominant deficit factor. The way Washington works, the politicians will take any unexpected additional decrease in interest costs and find a way to turn it into not narrower deficits, but additional spending. That will fuel inflation, which could drive interest rates up all over again. A virtuous cycle, it isn’t.

Good news from Israel: One of the information sources I’ve found most useful since October 7 has been a regular video briefing by Israel’s Defense and Security Forum. This morning’s briefing featured Brigadier General (reserve) Yossi Kuperwsser, who is the forum’s research director.

“Israel is better prepared now than it was five months ago,” Kuperwasser. “If you seek peace, you have to be prepared for war.”

He said the chance of avoiding a war with Hezbollah in the North is “not very high, but it is not zero, and we have to do whatever we can in order to raise the chances.”

Kuperwasser is author of a June 2023 policy paper that argued, “rid Israel of Hamas's threat by disarming it, prohibiting its rearmament, and demonstrating conclusively that threatening Israel is indisputably against its interests.” In retrospect, that was excellent advice, and had Israel followed it rapidly then, October 7 might have been prevented.

Kuperwasser’s remarks echoed those from Monday of the IDSF chairman and founder, Brigadier General (reserve) Amir Avivi. “I am very optimistic,” Avivi said. “Eventually in Gaza overall, in Rafah, we will win decisively. Yes, we see hurdles. Yes, it takes more time than what we want. But eventually we’ll go in and we’ll destroy Hamas. We’ll destroy them and we’ll find the hostages.”

“When I see the way our soldiers and commanders are excelling in combat, nothing is stopping them. I talk to the commanders who are fighting on the ground. They feel so much empowered by their capabilities to really decisively win every battle, and this is very, very reassuring.”

Said Avivi, “the army has improved exponentially since the beginning of the war.”

Flex economy: Axios and the Flex Association, a trade group that represents the rideshare and app-based delivery industry, have statistics with what they describe as a state-by-state breakdown of share of the workforce that “takes part in app-based work.” They say it is 4.3 percent of the workforce overall, with highs of 9 percent in D.C., 6.4 percent in Florida, 6 percent in Nevada, and 5.9 percent in Georgia. Even discounting for that the statistics come from the industry rather than a totally independent study, those are big numbers.

Naturally, labor unions would like a piece of the action. In Massachusetts, ballot questions that would categorize the drivers as employees (union-sponsored) or independent contractors (industry sponsored) await decisions by the state attorney general’s office. California voters in 2020 backed, 59 percent to 41 percent, a ballot initiative categorizing the drivers as independent contractors.

Who Is Ian Cain?: Can a black, gay Republican defeat Elizabeth Warren in Massachusetts? Ian Cain, the president of the city council in Quincy, Massachusetts, seems about to give it a try. He described himself to the Commonwealth Beacon as a pragmatic, Charlie Baker-style moderate. I wrote a column about how backing a Warren opponent in 2024 would be a great revenge opportunity for Mike Bloomberg. Cain is getting into the race late, but there is a history of surprise Republican Senate victories in Massachusetts. Scott Brown won in 2010 over Martha Coakley in a race for the seat that had been held by Senator Kennedy. There’s even a history of black Republican Senators from Massachusetts—Edward Brooke. Anyway, I reached out to Cain for an interview. It’s surely a long shot of a campaign, but it has the potential to be entertaining, particularly if Cain can draw some ideological contrasts against Warren.

Thank you!: The Editors is a reader-supported publication. If you aren’t yet a paying subscriber, please consider becoming one.

And if you find this newsletter to be of value, please help us grow by forwarding it to friends along with a recommendation that they subscribe.

Government keeps kicking the can down the road but at some point austerity measures will be needed to reign it in. Longer they wait the more painful the day of reckoning will be.

Fed created a lot of this mess along with the government. Do we miss the gold standard? Perhaps. Where have the fiscal conservatives gone?

We need a Republican senator. Warren is all ideology but no help to Massachusetts. Same with Markey. I remember Ed Brooke. He was a gentleman statesman. Hard to find them today.

It’s gotten ugly in Israel but they need to stick to the long term plan to rid of Hamas terrorism. No other option really