Is Elon Musk Using Trump to His Own Advantage?

Plus, Vance-Kraushaar fight; Harvard anti-Israel “die in”; Yale’s Snyder flees to Canada

Elon Musk, who is a key adviser to President Trump while also one of the world’s wealthiest individuals as the controlling owner of Tesla, SpaceX, and X (formerly Twitter), last night amplified a tweet by Jeremy Tate. Tate said, “I totally understand why teachers unions oppose school choice. I get it. As a business owner I too like the idea of not having to compete with anyone.”

Musk added the “100 percent” emoji, apparently to symbolize agreement. At the Editors, we’re all-in for school choice, and we certainly haven’t been as successful in business as Musk has. But if Musk was agreeing with the point about a business owner disliking competition in addition to the point about school choice and teachers union, then we at The Editors have a different, and more idealistic view than Musk of the role that competition plays in capitalism. It’s a shortsighted business owner who doesn’t appreciate competition. Competition among vendors and suppliers benefits the business owner as a customer. And, at best, competition also helps motivate businesses continually to improve quality, value, and service. Without ongoing competition, a business can become complacent, and the value it provides customers may slip to the point where the business eventually becomes vulnerable to a new entrant who offers a better product and price. Not competing with anyone may be a good way to extract monopoly profits at monopoly prices for a short period of time, but, aside from rare situations— “natural monopolies” such as regulated utilities—it is not a recipe for long-term business success.

But if Musk really dislikes competition so much that he will harness government power to defeat it, it potentially puts some of the Trump administration’s actions in unfavorable light. For example, the tariffs on automobiles (why automobiles, of all things?) will advantage Tesla by making vehicles sold by Tesla’s competitors more expensive to consumers. Musk has been doing impressive work cutting expenses, yet he is also, via SpaceX, a big government contractor. Tesla is in the solar energy business and is affected by all kinds of government decisions about electric car transitions, energy, and transportation policy.

A Harvard professor of practice who teaches economics, Jason Furman, had a set of social media posts this morning throwing cold water on this line of argument. “Elon Musk lost $9 billion over the last day. Rational profit maximizing oligarchy is not the right model for understanding our current public policy,” Furman tweeted. He followed with a Bloomberg screengrab showing that Musk’s net worth is down $96.2 billion year to date, making him the largest loser in absolute terms of anyone.

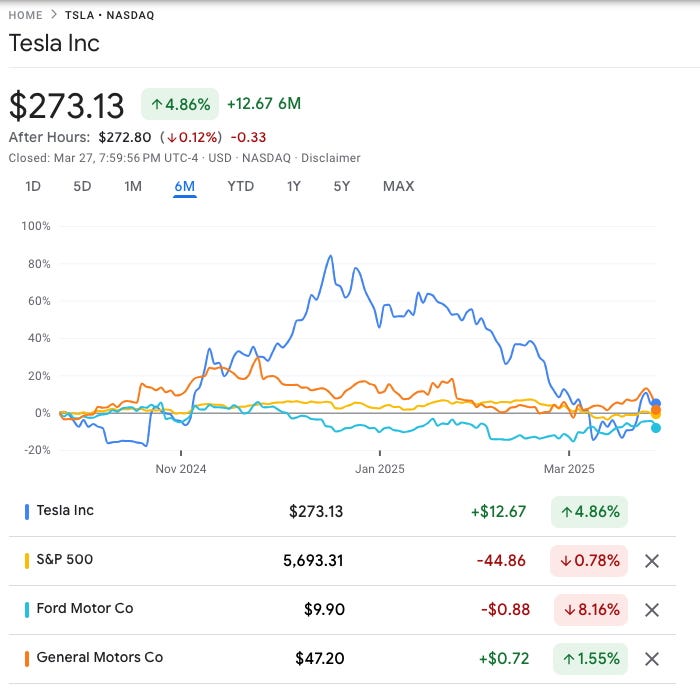

But maybe “year to date” isn’t the only comparison worth looking at. See the chart above, which shows that over the past six months—since before the election—Tesla has outperformed Ford, GM, and the S&P 500 Index, and is actually up about 5 percent over that term.

Maybe Musk’s plan is to generate concern about the conflict of interest, and then be forced to sell the stock—which he could then, under section 1043 of the tax code, entirely avoid paying capital gains tax on.

Vice President Vance versus Jewish Insider editor Josh Kraushaar: Vice President Vance took the unusual step of attacking the Jewish Insider and its editor, Josh Kraushaar. Vance posted to social media: “This morning, Josh Kraushaar ran a hit piece against me in Jewish Insider, which has become an anti-JD rag. It has many problems, including seven anonymous quotes from cowardly Republicans. But the most glaring factual error is the below, which says the Houthis killed three Americans last January. Actually, the group responsible for that attack was ‘Islamic Resistance in Iraq,’ which is an entirely different militia group.”

We read the Jewish Insider article. It includes an on-the-record quote from Senator Thom Tillis, Republican of North Carolina, along with a lot of anonymice and a quote from Donald Trump Jr. saying, “These seven cowardly neocons attacking JD anonymously are genuine pussies.”

Jewish Insider corrected the piece: “Correction: A previous version of this article stated that the Houthis were responsible for an attack that killed three American service members. That attack was conducted by Kataib Hezbollah, another Iranian proxy group.” But it’s worth noting that three American service members have indeed died in Operation Prosperity Guardian, the mission against the Iran-backed Houthis aimed at defending the freedom of the seas. Aviation Machinist’s Mate 2nd Class Oriola Michael Aregbesola, of Florida, was lost overboard in the Red Sea on March 20, 2024. And two U.S. Navy SEALS, Navy Special Warfare Operator 1st Class Christopher Chambers, 37, and Navy Special Warfare Operator 2nd Class Nathan Ingram, 27, were also lost at sea on January 11, 2024, while conducting “a night-time seizure of a dhow conducting illegal transport of advanced lethal aid from Iran to resupply Houthi forces in Yemen as part of the Houthis’ ongoing campaign of attacks against international merchant shipping.”

As for whether the Iraqi group is “entirely different” from the Houthis in Yemen, Vance can draw all the fine distinctions he wants, but most Americans have figured out by now that the Islamist extremists trying to kill Americans and Israelis aren’t all acting totally independently but share certain characteristics, such as, for example, that they are Islamist extremists trying to kill Americans and Israelis.

Harvard anti-Israel die-in: I swung by Harvard Yard this morning to check on an advertised anti-Israel “die-in” on the steps of Widener Library.

There was good news and bad news. The good news is that the event attracted an almost comically small crowd—it peaked at 40 participants. That could be attributable to the measures taken by the Trump administration to deter foreign students from participating in such events, and it could be that Harvard University actions helped to diminish the crowd by locking all but a few of the gates of Harvard Yard, and by restricting access to Harvard ID-holders at the gates that were open. Anyway, observing the small clump of anti-Israel activists, diminished from the larger crowds of last year, it was hard to avoid wondering how they became front-page news and a top political agenda item. This is what all the fuss was about?

The bad news is that there remain 40 Harvard community members, led by Crimson editorial editor Violet Barron, who will volunteer to dress up in keffiyehs and medical masks, falsely accuse Israel of genocide, and engage in call-and-response chants such as “we will honor all our martyrs” and “from the river to the sea, Palestine will be free.” Under the circumstances—an Israeli war of self-defense against Iran-backed terrorists whose goal is death to Israel and to America—it seems grotesquely tasteless, a sign of poor judgment, and a visible educational failure of the host institution.

I wasn’t able to stay on campus into the evening for the scheduled event at Harvard Divinity School—in Swartz Hall—on “Christ in the Rubble: Faith, the Bible, and the Genocide in Gaza.”

Snyder to Canada: “Three prominent Yale professors depart for Canadian university, citing Trump fears,” is the not-a-parody Yale Daily News headline. One of the three is Timothy Snyder, author of the book “On Tyranny” and of a New Yorker article headlined “What Does It Mean that Donald Trump Is a Fascist?” He also has a Substack newsletter that reaches an audience about 80 times the size of this one.

It’s one thing for the people who live in New Haven to move to Canada. When the people who live in Palo Alto or Pasadena start considering it, that’s when to get concerned.

Rubio on the foreign students: Secretary of State Rubio had this response when asked about the Turkish Tufts student captured this week:

We revoked her visa. It’s an F-1 visa, I believe. We revoked it, and here’s why—I’ve said it everywhere, and I’ll say it again. Let me be abundantly clear: If you apply for a student visa to come to the United States and you say you’re coming not just to study, but to participate in movements that vandalize universities, harass students, take over buildings, and cause chaos—we’re not giving you that visa. If you lie, get the visa, and then engage in that kind of behavior once you’re here, we’re going to revoke it. And once your visa is revoked, you’re no longer legally in the United States. Like every country, we have the right to remove you. It’s that simple. It’s crazy—stupid, even—for any country to let people in who say, ‘I’m going to your universities to riot, take over libraries, and harass people.’ I don’t care what movement you’re with. Why would any country allow that? We gave you a visa to study and earn a degree—not to become a social activist tearing up our campuses. If you use your visa to do that, we’ll take it away. And I encourage every country to do the same. Every country has the right to decide who enters as a visitor. If you invite me to your house for dinner and I start putting mud on your couch and spray-painting your kitchen, you’re going to kick me out. We’ll do the same if you come to the U.S. and cause a ruckus. We don’t want that here. Go do it in your own country—but not in ours.

With anti-Israel activists threatening to start encampments at various colleges at the beginning of April, one hopes that the guards checking IDs at the gates won't let people carry in tents this year. In the days before the 2024 encampment, there were posted signs saying that bringing in tents would not be allowed, but that wasn't enforced.

If this column had been written in December one could have pointed to the 80% increase in the price of Tesla stock and claimed that Musk was making out like a bandit. But as Musk's new role became apparent, leftists wanting to drive the most popular American electric car out of business have erased those gains, so it is hard to make the Musk private benefit argument.

One good comparison would be to how Tesla would have done if Harris were elected. The leftists would still have been angry at Musk and Tesla stock might have dropped without there having been a November gain. But of course we will never have such data.

Another good comparison would be to how Tesla would have done if Musk had stayed out of politics. There would not have been much anger from leftists at Tesla, but the markets may have plunged because of the policies expected from Harris that caused tech leaders to rally behind Trump. But of course we will never have this data either.

I take Musk seriously when he says the country would have gone down the drain if Harris were elected, and that was the reason for Musk getting involved. Musk made an audacious gamble in getting involved - who would have imagined the richest person on earth spending weeks barnstorming Pennsylvania to promote Trump's candidacy? Musk's involvement seems more motivated by MAGA public benefit than by Musk private benefit.