House Budget Backs Growth

Plus, The Editors live on video at noon today

Program note: I’m planning a “live” video event—the first ever for The Editors—today at noon eastern time with Mark Oppenheimer of the Oppenheimer Substack. We’ll be discussing the Christian revival in Silicon Valley. Oppenheimer is professor of practice at the John C. Danforth Center on Religion and Politics at Washington University in St. Louis and is executive editor of Arc, an online journal based at the center. He’s been a religion columnist for the New York Times, a longtime teacher of nonfiction writing at Yale, and was the creator of Gatecrashers, the Tablet podcast series about Jews in the Ivy League. To listen to today’s event in real time you’ll need the Substack app, so if you haven’t already installed it, this would be a fine opportunity. I’m hoping to make the video available afterward, so if you can’t make it at noon today, don’t stress about it, but if you can make it, please do join us. It should be fun. If all goes as planned, you should get an alert or an email when the show starts.

***

Press coverage of the House Budget Committee resolution released yesterday has mostly focused on the spending-cut numbers that lead toward a balanced budget — “It is the goal of this concurrent resolution to reduce mandatory spending by $2 trillion over the budget window.” Less noticed, but still noteworthy, is the language in the resolution about growth.

A section of the resolution called “Policy Statement on Economic Growth,” includes the following findings:

(1) The rate of economic growth has a significant impact on budget deficits. When the rate of gross domestic product (GDP) increases, projected revenue grows with it and deficits decline. Conversely, slower GDP growth can lead to lagging revenues and mounting deficits.

(2) Federal policies affect the economy’s potential to grow and impact economic performance, influencing budgetary outcomes. Consequently, fiscally responsible policies that improve the economy’s long-term growth prospects help reduce the size of budget deficits over a given period.

(3) The free market, where individuals pursue their own self-interests, has been responsible for greater advancements in quality of life and generation of wealth than any other form of economic system. Federal policies designed to grow the economy should thus allow market forces to operate unhindered rather than pick ‘‘winners’’ and ‘‘losers’’

(b) POLICY ON ECONOMIC GROWTH .—It is the policy of this concurrent resolution to pursue policies that embrace the free market and promote economic growth policies that

(1) reduce Federal spending;

(2) expand American energy production;

(3) lower taxes that discourage work, savings, and investment;

(4) deregulate the economy and enact reforms to diminish bureaucratic red tape; and

(5) eliminate barriers to work so more Americans enter (or reenter) the job market

People sometimes say that what really matters are the actions not the rhetoric. There is some truth to that, but there’s also some truth to the notion that ideas matter. Sometimes the words aren’t just rhetorical flourishes but a reliable signal of policy intention. And sometimes the rhetorical tone has a way of influencing the outcomes.

One could tinker with or improve the language in the resolution, but directionally, “free market,” “allow market forces to operate unhindered,” “lower taxes,” “deregulate the economy,” “grow the economy” and “generation of wealth” are all encouraging.

There is no shortage of coverage of possible reasons to be gloomy about the economy—tariffs, uncertainty, a weak dollar, persistent inflation, the risk of war. We have covered some of those risks here, and readers click— “negativity bias” is a real thing. But there are hopeful signs as well.

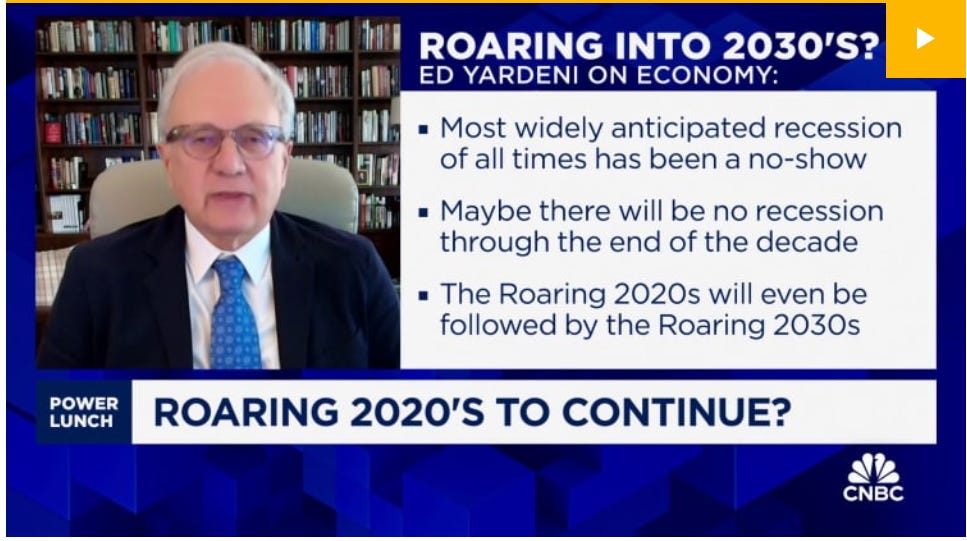

The most recent New York Fed Staff nowcast is estimating 3.12 percent GDP growth for the first quarter of 2025, with 4.25 percent growth inside the 50 percent probability window. The stock market seems to be perceiving the hopeful signs, as do a few analysts—check out Ed Yardeni on CNBC talking about how the roaring 20s may even be followed by a roaring 30s. CNBC’s Kelly Evans was talking in the Yardeni segment about the market “ignoring Washington,” and that could be part of it, but another thing that could be happening is that the markets, or at least some participants in them, are watching Washington and like what they see. Or, at a minimum, they are not as panicked as the newsroom headline writers and university administrators are.

Medicaid cuts=as usual GOP penalizing the most vulnerable.

Did anyone suggest the business community and the American consumers liked what they saw in DC back in the spring and summer of 2023 when the market first took off on this sustained run?