Harvard’s China Cheerleader

Plus, Bret Stephens is wrong about Bibi; office building values and local taxes

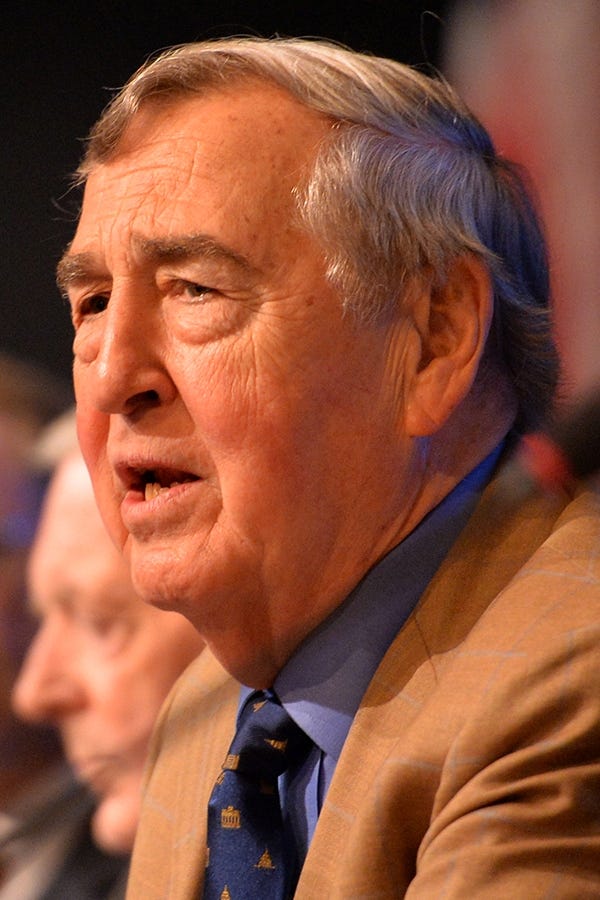

The Douglas Dillon professor of government at the Harvard Kennedy School, Graham Allison, recently back from “9 intense days of meetings in Beijing,” including a discussion with Xi Jinping, is now tweeting out boosterish propaganda about the Chinese Communist economy.

“Contrary to the belief that investors have lost all confidence, private investment increased about 10% in 2023 when excluding the real estate sector,” Allison posted on X. “China’s real GDP (growth minus inflation) is now 20% larger than it was before the COVID pandemic. The US economy has grown by only 8%.”

The statistics are drawn from a Foreign Affairs article, “China Is Still Rising,” by Nicholas Lardy.

I take Chinese Communist economic statistics with same boulder of salt I’d take statistics issued by any other Communist-controlled government. That is to say, they are unreliable. Allison and Lardy treat them as if they are gospel, giving the figures the kind of deferential treatment that the mainstream press and Ivy League professors usually reserve for, say, instant casualty counts from the Hamas-controlled Gaza health ministry.

A working paper from Luis Martinez of the Harris School of Public Policy at the University of Chicago, “How Much Should We Trust the Dictator’s GDP Growth Estimates,” found that “autocracies overstate yearly GDP growth by as much as 35%.” Nor is Martinez the first to make that observation. As his working paper notes, “Previous empirical work has systematically questioned the credibility of the official statistics produced by China’s autocratic regime.” Martinez used nighttime lighting data from satellite photos to check whether the reported growth numbers were real.

A 2019 paper from Brookings by three Hong Kong-based scholars and one from the University of Chicago, “A Forensic Examination of China’s National Accounts,” found “China’s national accounts are based on data collected by local governments. However, since local governments are rewarded for meeting growth and investment targets, they have an incentive to skew local statistics.” Even the local statistics are then subject to “adjustment” at the national level.

None of that is mentioned by Allison or by Lardy, who appear just to take for granted that the Chinese Communist data is trustworthy.

Lardy claims it is a “misconception” and “not supported by the data” that “Xi had undermined investor confidence; entrepreneurs no longer saw the government as a dependable steward of the economy. So long as Xi is in power, runs a common argument, entrepreneurs will continue to hold back on investing in China, opting instead to funnel their wealth out of the country.” Any American noticing Chinese buying expensive real estate in Boston, New York, and Miami will have a hard time dismissing the “funnel their wealth out of the country” claim as a “misconception.”

At least Lardy nods vaguely in the direction of “problems… resulting from Xi’s efforts to exert greater control over the economy.” Professor Allison doesn’t even mention that.

Nor do either Allison or Lardy mention what the U.S. government says is China’s ongoing genocide against Uyghurs in Xinjiang.

Here is one Chinese economic statistic you can believe, courtesy of CNBC, as of April 3, 2024: “Stocks in China and Hong Kong sold off a massive $4.8 trillion in market capitalization since 2021.” Without rule of law and strong property rights, why invest there?

Recent work: “Bret Stephens, Swinging Behind Schumer, Blames Netanyahu” is the headline over my New York Sun column rebutting Bret Stephens’s recent “Netanyahu Must Go” article. I take his arguments apart and do not find them persuasive. I also am uneasy about Americans, whether Senator Schumer or President Biden or Stephens, pressing for the ouster of Israel’s elected prime minister.

Urban tax gap: St. Louis’s “largest office building, the 44-story AT&T Tower,” “recently sold for around $3.5 million,” the Wall Street Journal reports, “a sliver of the $205 million it sold for in 2006… In 2022, it changed hands for just $4 million.”

For cities that fund their services with property tax revenue, plummeting office building values have a ripple effect. Instead of addressing the problems that led to the declining values, some cities seem more focused on simply finding another way to recover the tax revenues.

In Seattle, advocates are pushing a November ballot referendum, Initiative 137, that would collect an additional $50 million in revenue with a new “excess compensation” tax on businesses with employees making over $1 million a year. One real-estate-industry-published article about the proposal paraphrases a commercial real estate broker warning that “raising business taxes could have a chilling effect on the Puget Sound region's efforts to retain and attract tech companies and other businesses that are the backbone of the area's economy.”

In Boston, Mayor Wu is proposing to raise commercial property tax rates to compensate for the sinking property values. A Bloomberg News article quotes NYU professor Mitchell Moss, characteristically shrewd, who warned of, as Bloomberg paraphrased it, “the risk of driving businesses and property owners to alternative locations for office space.” From the Bloomberg story:

“You don’t raise taxes on an industry which is suffering because you’re going to make it less competitive,” Moss said.

Thank you!: What our customers are saying about The Editors: “Just canceled my Washington Post subscription so I'll sub it in.” “Thought provoking.” “I always learn something new.” “a highlight of my day.” Please help us grow by sharing this newsletter with a friend along with the suggestion that they sign up.

Office building value decline is a big issue for cities but important to distinguish cities like Boston from St. Louis and similar. St. Louis is in a doom loop with no easy solutions while in Boston residential properties have exploded in value over the past couple decades yet assessments have not kept up (because elected officials like to keep their jobs). Home on Lime St being marketed for $18m with an assessment at $7m is just the tip of an expensive iceberg. Boston should certainly look to pare its budget but a much healthier solution than piling on to office buildings already declining in value would be to appropriately assess the homes citywide where many have built a small fortune (on paper).