European Regulations Strangle Prosperity, Stripe Annual Letter Says

Plus, Senator Cotton on 7 Things You Can’t Say About China; terrorist's “charm”

The privately held payment-processing company Stripe is out with its annual letter from cofounders John and Patrick Collison. “Businesses on Stripe generated $1.4 trillion in total payment volume in 2024, up 38% from the prior year, and reaching a scale equivalent to around 1.3% of global GDP,” they write. For our purposes the news is less the business than the public-policy commentary related mainly to Europe, and how Europe lags America in productivity because its economy is less free.

The Stripe guys do a nice, clear, common-sense job of explaining this.

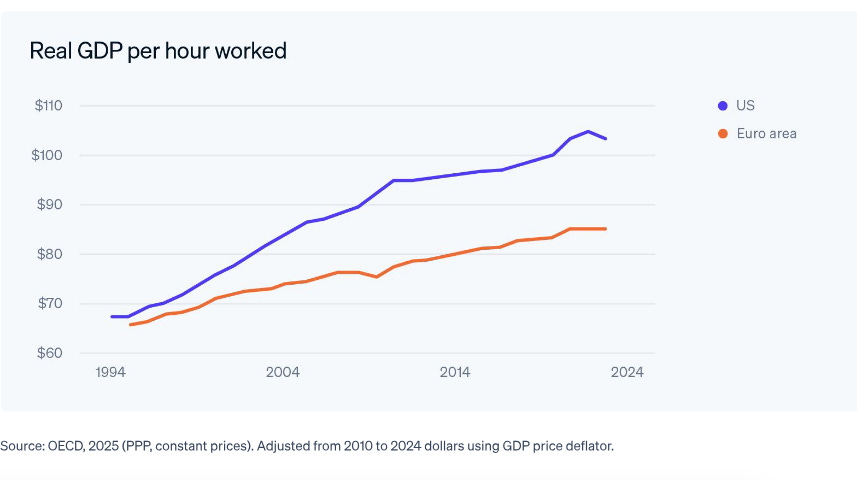

While the economies of the US and Europe were similarly productive in 1990, there has since been a stark divergence, with US productivity per hour worked reaching $104, as compared with a plateau of something closer to $85 per hour in Europe. Contrary to popular belief, the European economy isn’t weakened because people take longer lunch breaks or because the continent takes the month of August off. (European working hours have actually been increasing.) The European economy is challenged because it’s getting less output from each hour worked.

Europeans doubt this will change anytime soon. “We recently ran a survey of US and European founders... 45% of European founders say that the European business climate is getting worse (compared with only 15% of US founders). Even more strikingly, founders in Europe are twice as likely to see North America as an opportunity for growth than Europe itself. Furthermore, 66% of European founders say that European technology-related policy changes over the past four years have been unhelpful.”

Among their recommendations: “Europe needs a broader, deeper, and more diverse array of financing solutions. In the US, almost 80% of corporate lending is now from non-bank sources, compared to just 32% in the EU.”

Also:

Europe clearly needs major regulatory reform and simplification. EU Commission President Ursula von der Leyen recently said that there is ‘too much complexity’ and that ‘administrative procedures are too cumbersome.’ To make this concrete, one German entrepreneur recently reported:

“My previous (non-German) company was incorporated in Delaware and I opened a bank account within a few days. When fundraising, the only thing between investors committing capital and me receiving the money was an electronic signature via Docusign and the investors wiring the funds. Because of the notary system in Germany, the process for my new company will be incredibly painful. Setting up the corporate structure will take 2–3 months. Explaining the need for physical signatures to American angel investors makes fundraising difficult. I will need to burn through my savings for 4 –5 months longer than I would need to if I was opening a business in the US.”

We don’t think that anyone in Europe deliberately made it a policy goal to discourage the creation or success of new firms, but this has been the inadvertent result.

And, “Europe’s labor rules and limits on corporate restructuring make adaptation harder.”

These Stripe guys aren’t coming at this from the perspective of free-market ideologues. They are looking at it from the perspective of practical businessmen who operate in the U.S. and in Europe, notice the stark differences, and want to grow along with their customers. The U.S. and Delaware aren’t exactly libertarian utopias, and there is plenty of room for improvement here, but compared to a lot of the rest of the world, America a pretty attractive place. (As an aside, this helps to explain why U.S. stocks are trading at higher valuations than European ones. Some say that’s a reason to buy Europe, because it’s a relative bargain. But without the public policy reforms, it may stay a bargain. And that’s not even talking energy or tax, it’s just regulation.)

From an American perspective, you could say, let Europe decline, because the worse it is there, the better it is for us—we don’t have to worry about the competition. But it’s a longer-sighted view to try to help Europe—and other places—improve, on the theory that a rising tide will lift all boats, and a freer, faster-growing global economy will be good for America, too.

Seven Things You Can’t Say About China: Senator Tom Cotton, Republican of Arkansas, has a new book out called “Seven Things You Can’t Say About China.” It will be no. 1 in the March 9, 2025, issue of the New York Times hardcover nonfiction bestseller list. You might wonder, what are the seven unsayable things? According to the senator, and according to the book, they are:

China is an evil empire.

China is preparing for war.

China is waging economic world war.

China has infiltrated our society.

China has infiltrated our government.

China is coming for our kids.

China could win.

From the book’s prologue: “let me stress that Chinese communism is the threat, not the ancient Chinese civilization or the Chinese people, the first and worst victims of Chinese communism.”

There’s even a Harvard angle. Cotton writes, “I was appalled in 1997 as a student at Harvard when the university invited Jiang Zemin to speak on campus.”

If China does not prevail it will be in part because of the internal weaknesses inherent in unfree societies and in central planning. But it may also be because some Republicans and Democrats in Congress—Cotton most definitely among them—perceived the threat clearly and educated the public about it.

Recent work: “New York Times Praises ‘Charm’ of Hezbollah Terrorist Leader” is the headline over my latest piece for the Algemeiner. You can check the column out there (no paywall) if you are interested in that sort of thing. I emailed the Times reporter and asked her “How would you respond to families of victims of Hezbollah-sponsored terrorism who did not find it charming to have their loved ones killed by Hezbollah?”

Comment of the Day: From Michael Segal, commenting on yesterday’s news that a judge dismissed a lawsuit by Harvard alumni who said the university had degraded the value of their degrees by its failure to counter rampant antisemitism on campus: “The 10 Harvard alumni plaintiffs are not alone in their feeling that their degrees are now an embarrassment. One of my Harvard roommates has turned around his 2 Harvard diplomas in his office out of such a feeling. But as with wine, the value depends on the vintage, and 1970s vintages of Harvard were impressive, as I detailed in 2004 in the WSJ, mirrored at https://segal.org/leadership/know/. To update that assessment two decades later I note that our class now also includes the Chief Justice of SCOTUS and a cabinet member. College connoisseurs, as with wine connoisseurs, can tell the difference among various vintages.”

Thank you: Thanks to all our readers. You can help us grow by forwarding this newsletter to a friend or family member who might enjoy it, along with a suggestion that they subscribe.

I have a very positive opinion of Senator Cotton, but I disagree with Cotton's opposition to inviting bad guys to speak at a university. In 2007 Iranian president Ahmadi-nejad was invited to talk at Columbia. I supported the invitation, based on the principle that one of the benefits of free speech is that it makes it easier to spot the idiots.

What happened was exactly that:

https://magazine.columbia.edu/article/ahmadinejad-columbia-campus-view

"... when asked during the question-and-answer period about the executions of homosexuals in Iran, Ahmadinejad replied through an interpreter that, "In Iran, we don't have homosexuals like in your country." The remark drew derisive laughter and boos from much of the audience and became the most talked-about of all his quotes. Some students felt that this denial of fact did more to discredit Ahmadinejad than anything else, validating the notion that free speech, among its other virtues, permits an objectionable speaker to hang himself with his own words."