Banks Sue Fed Over Stress Tests

Plus, Chinese Communist war on Christmas; NYT on racist Republicans

Banks are suing the Federal Reserve over “stress tests,” arguing that the secretive and ever-changing series of scenarios regulators use to set bank capital requirements are “imposing billions of dollars in unexpected capital burdens on individual banks with no evident reason, and with adverse effects on the economy as a whole.”

“The Board’s lack of transparency results in significant and unpredictable volatility in banks’ capital requirements. This, in turn, impairs the ability of banks to efficiently deploy capital, including making loans to small businesses and others who are crucial engines of growth and job creation in the U.S. economy,” the lawsuit says. “When banks are forced to hold excess capital—not to protect against the risk of loss, but instead to guard against the volatility of the Board’s undisclosed and ever-changing criteria—it reduces credit availability, hinders economic growth, and harms the American consumer.”

The complaint says the stress-tests are illegal because they avoid the notice and comment process required by a federal law known as the Administrative Procedure Act.

The lawsuit is filed in the U.S. District Court for the Southern District of Ohio. The plaintiffs include the Bank Policy Institute, a trade association that represents banks including Bank of America, Citgroup, Citizens, Fifth Third, Goldman Sachs, Huntington Bancshares Inc., JPMorgan Chase, Morgan Stanley, PNC, U.S. Bancorp, and Wells Fargo. Other plaintiffs include the Ohio Chamber of Commerce, the Ohio Bankers League, the American Bankers Association and the Chamber of Commerce of the United States of America.

The complaint quotes the Chamber of Commerce claiming that “stress testing may be driving steep declines in small business lending.”

The plaintiffs are represented by 13 lawyers, the most prominent of whom is Eugene Scalia of Gibson, Dunn. Scalia is a former Secretary of Labor.

The press release announcing the lawsuit answers the “why now?” question with reference to a statute of limitations expiring in February 2025. Yet for students of banking regulation, it’s hard to avoid the emotional resonance of a Christmas-Eve filing in the context of “It’s a Wonderful Life,” a Christmas movie about a bank run. The release says, “Although this legal action targets the stress test, its goal is not to eliminate it — only to subject its key components, both the scenarios and the models, to the benefits of public transparency through notice-and-comment rulemaking.”

The Fed anticipated the suit in a press release issued on at 4 p.m. December 23. “In view of the evolving legal landscape, the Federal Reserve Board will soon seek public comment on significant changes to improve the transparency of its bank stress tests and to reduce the volatility of resulting capital buffer requirements,” the release says. “Capital acts as a cushion to absorb losses and allows banks to continue lending to households and businesses even during a recession. Since its inception over 15 years ago, large banks in the stress test have more than doubled their capital levels, an increase of more than $1 trillion.”

If the banks succeed in beating back the regulators with litigation, they may be able to make more loans and, if things work out well, more money. The flip side—and the reason the stress tests were implemented to begin with—is the risk of a 2008-style liquidity or solvency problem. President Trump has vowed generally to reduce regulations, but he’s also promised to cap credit card interest rates at ten percent and in December 2023 vowed somewhat menacingly, “We’re gonna get those banks when we get in office, we’re gonna get 'em.” Trump controls the “independent” Fed only tenuously by appointing members of its board of governors.

Much of the lending action has moved away from banks to nonbank lenders, and much of the mortgage origination action has moved away from banks to nonbank loan originators, so in some ways the financial action has moved away from the big banks. They are significant, though, in the federal debt and deficit picture, because part of the “capital” that the banks are required to hold as reserves against deposits are federal government notes and bonds.

Merry Christmas from Moolenaar: Chairman John Moolenaar of the House Select Committee on the Chinese Communist Party is marking the Christmas holiday with a statement noting the lack of religious liberty in China:

“As Americans celebrate Christmas this week, I pray that one day the people of China will be able to enjoy freedom of religion. Ever since Jesus arrived in a manger, rulers from Herod to Xi Jinping have tried to silence the news of his birth and they have always lost. Right now, the Chinese Communist Party denies citizens the joy of Christmas, forces people of faith to either worship in secret or submit to the state, and jails many religious followers indefinitely. Those persecuted by the CCP today have been courageously steadfast in their faith and they are an inspiration for all those who stand against the Party’s brutal oppression. As Americans, we are blessed to live in a nation that values religious liberty, and in the competition between the United States and the CCP, our nation’s freedoms will be victorious.”

New York Times theory of Republican ascent: A December 21 New York Times obituary of Lee Edwards, who we wrote about here back on December 12, includes this passage:

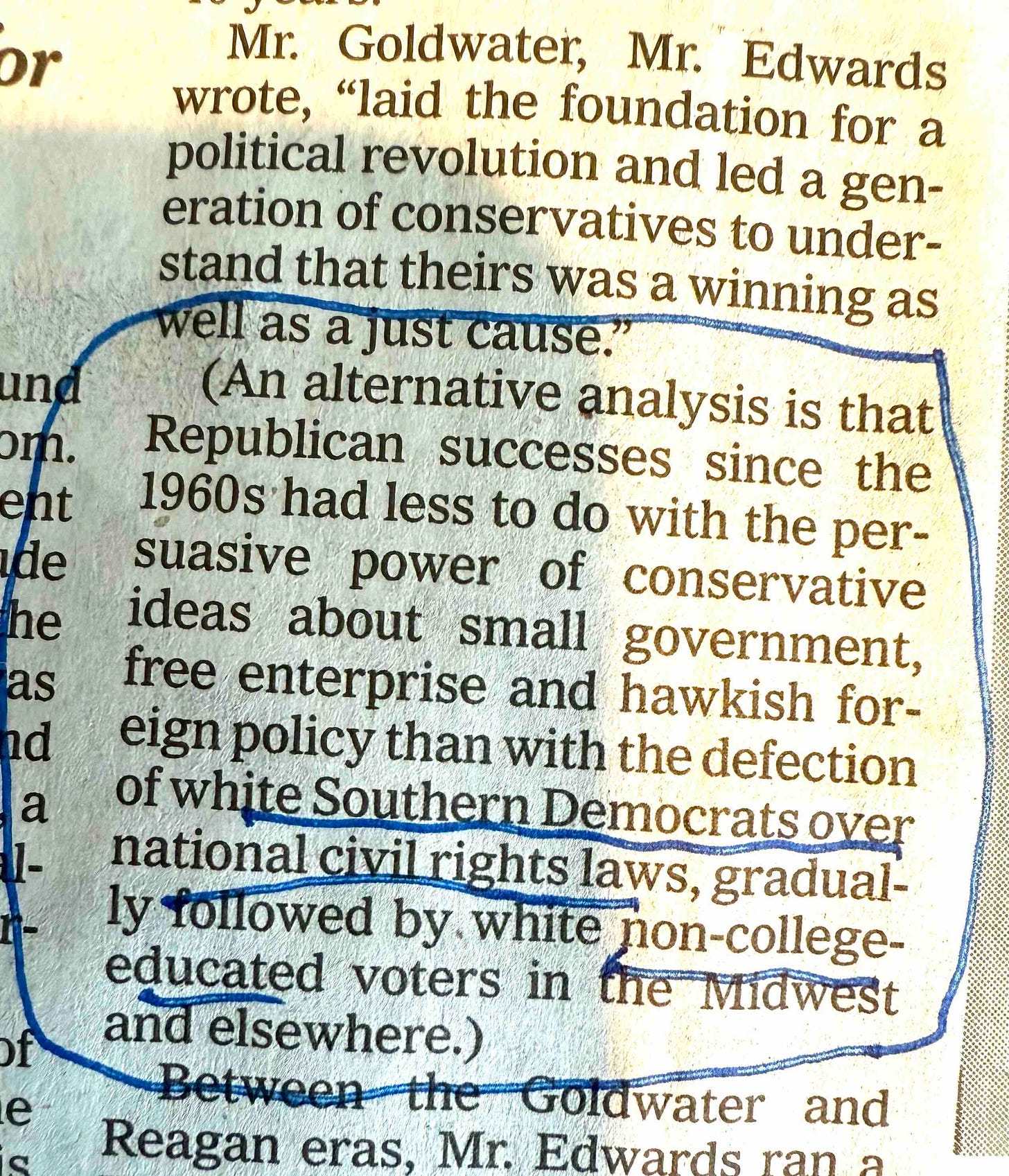

Mr. Goldwater, Mr. Edwards wrote, “laid the foundation for a political revolution and led a generation of conservatives to understand that theirs was a winning as well as a just cause.”

(An alternative analysis is that Republican successes since the 1960s had less to do with the persuasive power of conservative ideas about small government, free enterprise and hawkish foreign policy than with the defection of white Southern Democrats over national civil rights laws, gradually followed by white non-college-educated voters in the Midwest and elsewhere.)

An obituary seems a strange place for the Times newsroom to be insisting that Republican victories are not because of Republican ideas about free markets, growth, and anticommunism but rather because Republican voters are a bunch of uneducated racists, but that’s today’s New York Times for you at its ideologically contentious worst. Will the New York Times obituary of Bill Clinton attribute Democratic electoral successes to his winning over white Southern Democrats with his pledges to “end welfare as we know it” and his repudiation of Sister Souljah? The author of the obituary was educated at Phillips Andover Academy and Middlebury. Easy for him to sneer condescendingly at the racist and uneducated Republican voters. This is one parenthetical that the Times editors should have edited out. Where were the editors?

Thank you: The Editor here is supported by paying subscribers. If you find the content of value, and can afford the $8 a month or $80 a year, please become a paying customer today and help keep the New York Times accountable, defend Christmas against the Chinese Communists, sustain our editorial independence, and ensure your full access to future content.

The article states, "... because part of the “capital” that the banks are required to hold as reserves against deposits are federal government notes and bonds."

I am unaware of any requirement for required reserves to be held in such a form.

The quality of copyrighted editing today is atrocious. I've been around long enough to notice the decline. Errors that decades ago would be found only in small town rags I see regularly in The Times.